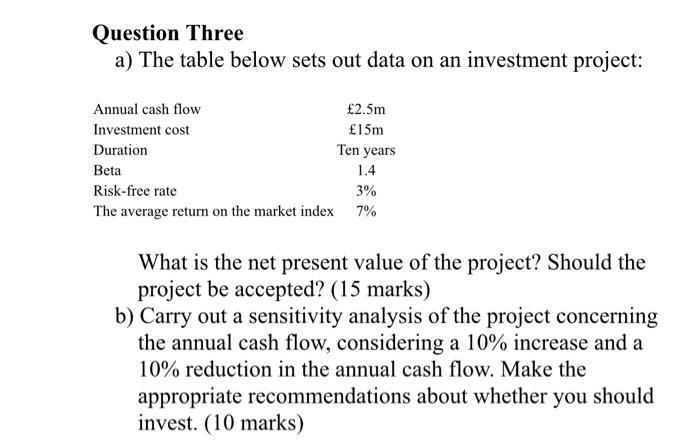

Question: Question Three a) The table below sets out data on an investment project: Annual cash flow 2.5m Investment cost 15m Duration Ten years Beta 1.4

Question Three a) The table below sets out data on an investment project: Annual cash flow 2.5m Investment cost 15m Duration Ten years Beta 1.4 Risk-free rate 3% The average return on the market index 7% What is the net present value of the project? Should the project be accepted? (15 marks) b) Carry out a sensitivity analysis of the project concerning the annual cash flow, considering a 10% increase and a 10% reduction in the annual cash flow. Make the appropriate recommendations about whether you should invest. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts