Question: QUESTION THREE (b) In the neoclassical growth model for a closed economy, the saving rate is exogenous and equal to the ratio of investment to

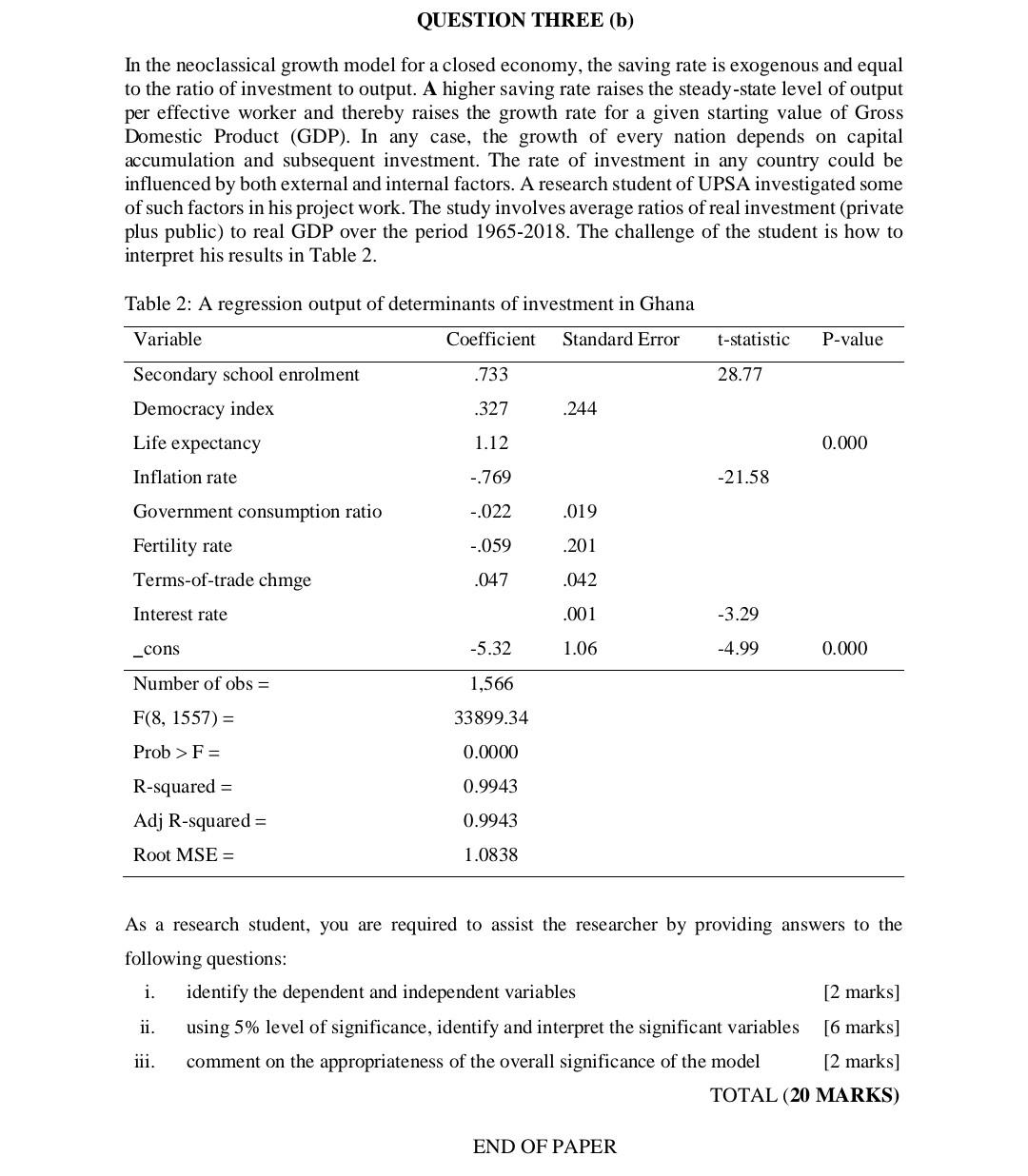

QUESTION THREE (b) In the neoclassical growth model for a closed economy, the saving rate is exogenous and equal to the ratio of investment to output. A higher saving rate raises the steady-state level of output per effective worker and thereby raises the growth rate for a given starting value of Gross Domestic Product (GDP). In any case, the growth of every nation depends on capital accumulation and subsequent investment. The rate of investment in any country could be influenced by both external and internal factors. A research student of UPSA investigated some of such factors in his project work. The study involves average ratios of real investment (private plus public) to real GDP over the period 1965-2018. The challenge of the student is how to interpret his results in Table 2. Table 2: A regression output of determinants of investment in Ghana Variable Coefficient Standard Error t-statistic P-value .733 28.77 .327 .244 1.12 0.000 -.769 -21.58 Secondary school enrolment Democracy index Life expectancy Inflation rate Government consumption ratio Fertility rate Terms-of-trade chmge Interest rate -.022 .019 -.059 201 .047 .042 .001 -3.29 _cons -5.32 1.06 -4.99 0.000 Number of obs = 1,566 F(8, 1557) = 33899.34 Prob > F= 0.0000 0.9943 R-squared = Adj R-squared = 0.9943 Root MSE = 1.0838 As a research student, you are required to assist the researcher by providing answers to the following questions: i. identify the dependent and independent variables marks] . using 5% level of significance, identify and interpret the significant variables [6 marks] iii. comment on the appropriateness of the overall significance of the model [2 marks] TOTAL (20 MARKS) END OF PAPER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts