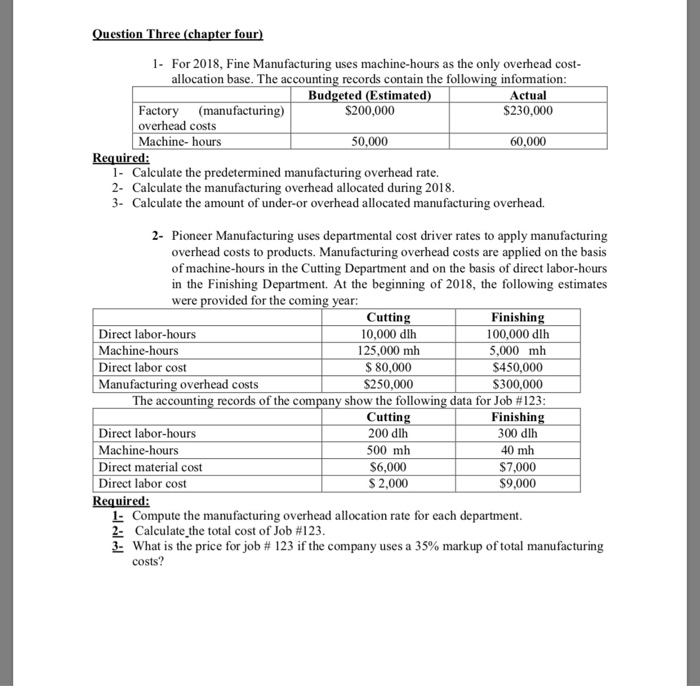

Question: Question Three (chapter four) 1. For 2018, Fine Manufacturing uses machine-hours as the only overhead cost- allocation base. The accounting records contain the following information:

Question Three (chapter four) 1. For 2018, Fine Manufacturing uses machine-hours as the only overhead cost- allocation base. The accounting records contain the following information: Budgeted (Estimated) Actual Factory (manufacturing) $200,000 $230,000 overhead costs Machine-hours 50,000 60,000 Required: 1- Calculate the predetermined manufacturing overhead rate. 2- Calculate the manufacturing overhead allocated during 2018. 3- Calculate the amount of under-or overhead allocated manufacturing overhead. 2- Pioneer Manufacturing uses departmental cost driver rates to apply manufacturing overhead costs to products. Manufacturing overhead costs are applied on the basis of machine-hours in the Cutting Department and on the basis of direct labor-hours in the Finishing Department. At the beginning of 2018, the following estimates were provided for the coming year: Cutting Finishing Direct labor-hours 10,000 dlh 100,000 dlh Machine-hours 125,000 mh 5,000 mh Direct labor cost $ 80,000 $450,000 Manufacturing overhead costs $250,000 $300,000 The accounting records of the company show the following data for Job #123: Cutting Finishing Direct labor-hours 200 dlh 300 dlh Machine-hours 500 mh 40 mh Direct material cost $6,000 $7,000 Direct labor cost $ 2,000 $9,000 Required: 1. Compute the manufacturing overhead allocation rate for each department. 2- Calculate the total cost of Job #123. 3- What is the price for job # 123 if the company uses a 35% markup of total manufacturing costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts