Question: Question Three - Equity and Debt (13 marks) 1) Kathy placed an order with her broker to purchase 1,500 shares of each of three IPOs

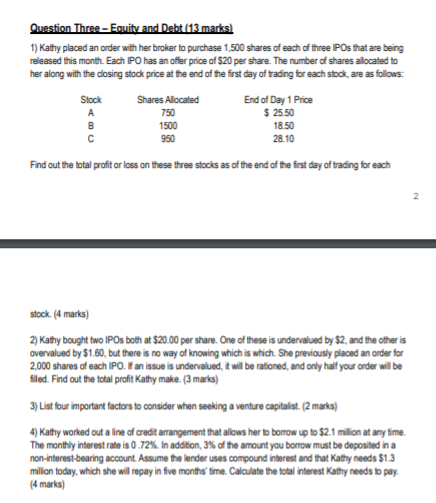

Question Three - Equity and Debt (13 marks) 1) Kathy placed an order with her broker to purchase 1,500 shares of each of three IPOs that are being released this month. Each IPO has an offer price of $20 per share. The number of shares alocated to her along with the closing stock price at the end of the first day of trading for each stock, are as follows: Stock Shares Alocated End of Day 1 Price 750 $ 25.50 B 1500 18.50 950 28.10 Find out the total profit or loss on these three stocks as of the end of the first day of trading foreach stock. (4 marks) 2) Kathy bought two IPOs both at $20.00 per share. One of these is undervalued by $2, and the other is overvalued by $1.60, but there is no way of knowing which is which. She previously placed an order for 2,000 shares of each IPO. If an issue is undervalued, it will be rationed, and only half your order will be filed. Find out the total profit Kathy make. (3 marks) 3) List four important factors to consider when seeking a venture capitalist. (2 marks) 4) Kathy worked out a line of credit arrangement that allows her to borrow up to $2.1 million at any time. The monthly interest rate is 0.72%. In addition, 3% of the amount you borrow must be deposited in a non-interest-bearing account. Assume the lender uses compound interest and that Kathy needs $1.3 million today, which she wil repay in five months' time. Calculate the total interest Kathy needs to pay. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts