Question: QUESTION THREE i) As the Project Manager for the EduStream project, you have received a report developed by JPMedia, which includes the following two tables.

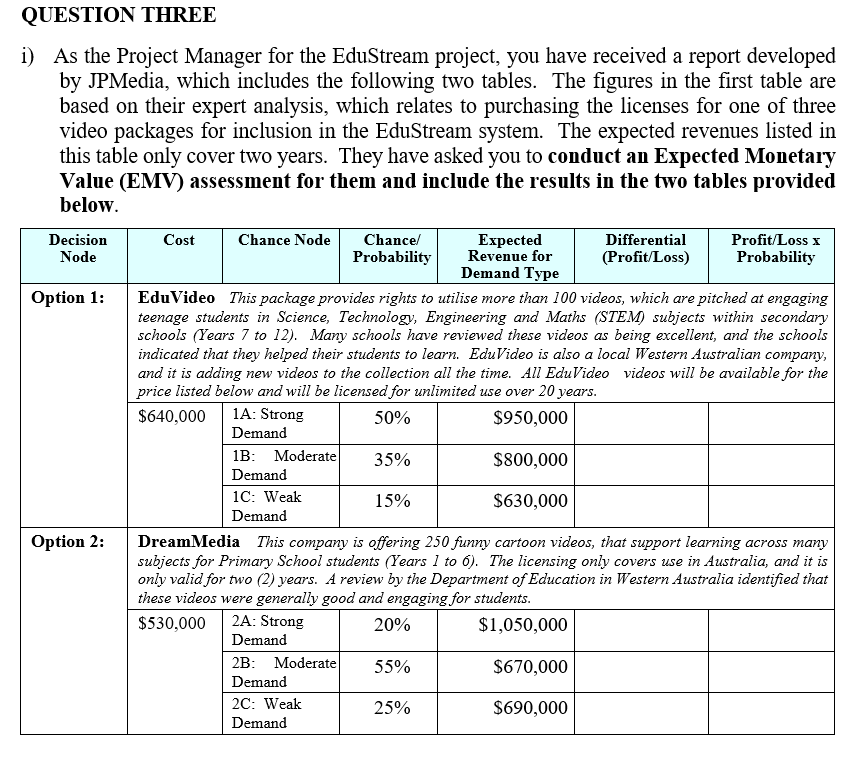

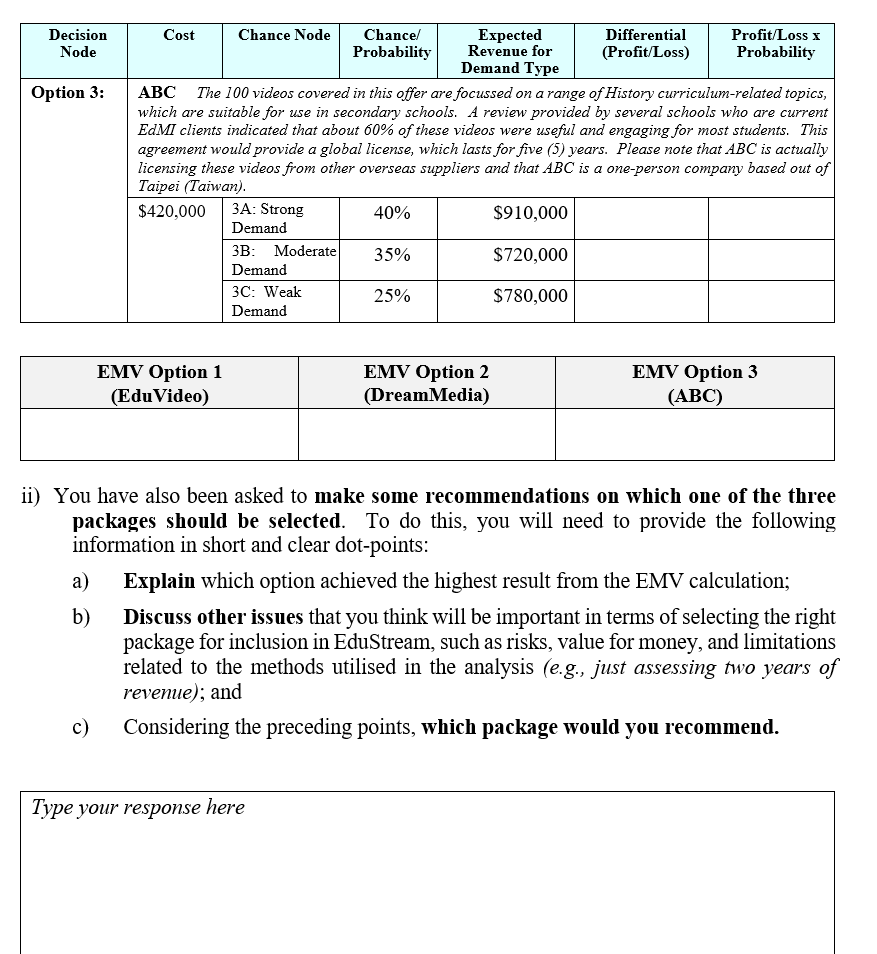

QUESTION THREE i) As the Project Manager for the EduStream project, you have received a report developed by JPMedia, which includes the following two tables. The figures in the first table are based on their expert analysis, which relates to purchasing the licenses for one of three video packages for inclusion in the EduStream system. The expected revenues listed in this table only cover two years. They have asked you to conduct an Expected Monetary Value (EMV) assessment for them and include the results in the two tables provided below. Decision Cost Chance Node Chance/ Expected Differential Profit/Loss x Node Probability Revenue for (Profit/Loss) Probability Demand Type Option 1: EduVideo This package provides rights to utilise more than 100 videos, which are pitched at engaging teenage students in Science, Technology, Engineering and Maths (STEM) subjects within secondary schools (Years 7 to 12). Many schools have reviewed these videos as being excellent, and the schools indicated that they helped their students to learn. EduVideo is also a local Western Australian company, and it is adding new videos to the collection all the time. All EduVideo videos will be available for the price listed below and will be licensed for unlimited use over 20 years. $640,000 1A: Strong 50% $950,000 Demand 1B: Moderate 35% $800,000 Demand 1C: Weak 15% $630,000 Demand Option 2: DreamMedia This company is offering 250 funny cartoon videos, that support learning across many subjects for Primary School students (Years ] to 6). The licensing only covers use in Australia, and it is only valid for two (2) years. A review by the Department of Education in Western Australia identified that these videos were generally good and engaging for students. $530,000 2A: Strong 20% $1,050,000 Demand 2B: Moderate 55% $670,000 Demand 2C: Weak 25% $690,000 DemandDecision Cost Chance Node Chance/ Expected Differential Profit/Loss x Node Probability Revenue for (Profit/Loss) Probability Demand Type Option 3: ABC The 100 videos covered in this offer are focussed on a range of History curriculum-related topics which are suitable for use in secondary schools. A review provided by several schools who are current EdMI clients indicated that about 60% of these videos were useful and engaging for most students. This agreement would provide a global license, which lasts for five (5) years. Please note that ABC is actually licensing these videos from other overseas suppliers and that ABC is a one-person company based out of Taipei (Taiwan) $420,000 3A: Strong 40% $910,000 Demand 3B: Moderate 35% $720,000 Demand 3C: Weak 25% $780,000 Demand EMV Option 1 EMV Option 2 EMV Option 3 (Edu Video) (DreamMedia) (ABC) ii) You have also been asked to make some recommendations on which one of the three packages should be selected. To do this, you will need to provide the following information in short and clear dot-points: a) Explain which option achieved the highest result from the EMV calculation; b) Discuss other issues that you think will be important in terms of selecting the right package for inclusion in EduStream, such as risks, value for money, and limitations related to the methods utilised in the analysis (e.g., just assessing two years of revenue); and c) Considering the preceding points, which package would you recommend. Type your response here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts