Question: Question Three marks) This question also concerns Constructco. Year One: Constructco purchases earthmoving equipment for $100,000. The plant is used in the company's business. There

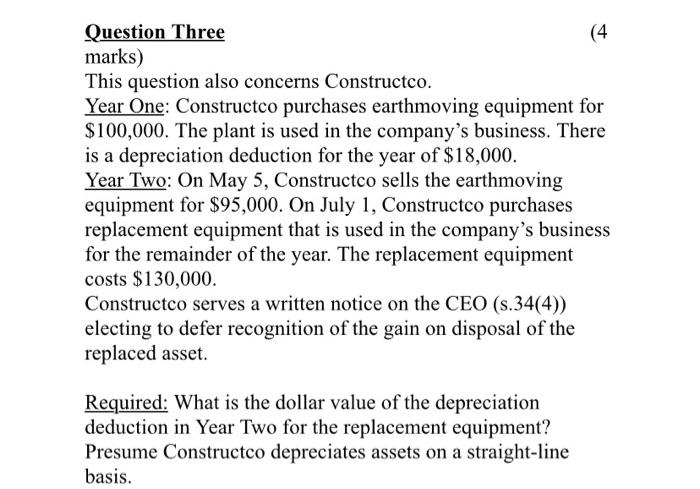

Question Three marks) This question also concerns Constructco. Year One: Constructco purchases earthmoving equipment for $100,000. The plant is used in the company's business. There is a depreciation deduction for the year of $18,000. Year Two: On May 5, Constructco sells the earthmoving equipment for $95,000. On July 1 , Constructco purchases replacement equipment that is used in the company's business for the remainder of the year. The replacement equipment costs $130,000. Constructco serves a written notice on the CEO (s.34(4)) electing to defer recognition of the gain on disposal of the replaced asset. Required: What is the dollar value of the depreciation deduction in Year Two for the replacement equipment? Presume Constructco depreciates assets on a straight-line basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts