Question: Question Three: Speculation Read the following case and answer the question that follows. Welles Fargo Bank, based in Los Angeles, California, has the ability to

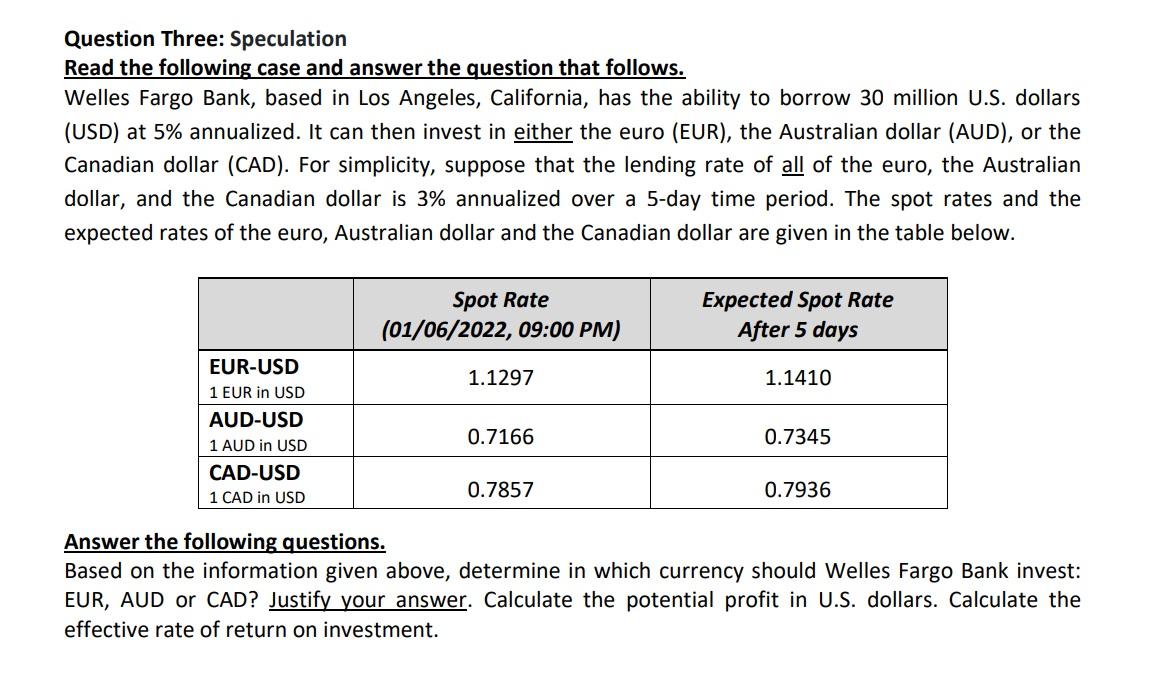

Question Three: Speculation Read the following case and answer the question that follows. Welles Fargo Bank, based in Los Angeles, California, has the ability to borrow 30 million U.S. dollars (USD) at 5% annualized. It can then invest in either the euro (EUR), the Australian dollar (AUD), or the Canadian dollar (CAD). For simplicity, suppose that the lending rate of all of the euro, the Australian dollar, and the Canadian dollar is 3% annualized over a 5-day time period. The spot rates and the expected rates of the euro, Australian dollar and the Canadian dollar are given in the table below. Spot Rate (01/06/2022, 09:00 PM) Expected Spot Rate After 5 days 1.1297 1.1410 EUR-USD 1 EUR in USD AUD-USD 1 AUD in USD CAD-USD 1 CAD in USD 0.7166 0.7345 0.7857 0.7936 Answer the following questions. Based on the information given above, determine in which currency should Welles Fargo Bank invest: EUR, AUD or CAD? Justify your answer. Calculate the potential profit in U.S. dollars. Calculate the effective rate of return on investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts