Question: Question Three [Total 20 Marks) () A businessman is considering an investment which requires an initial outlay of K60,000 and a further outlay of K25,000

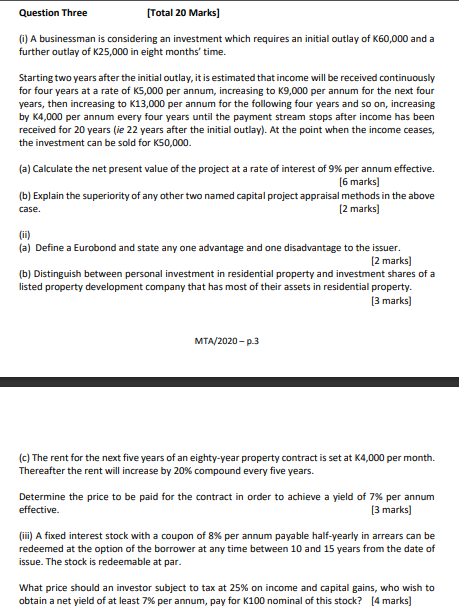

Question Three [Total 20 Marks) () A businessman is considering an investment which requires an initial outlay of K60,000 and a further outlay of K25,000 in eight months' time. Starting two years after the initial outlay, it is estimated that income will be received continuously for four years at a rate of K5,000 per annum, increasing to K9,000 per annum for the next four years, then increasing to K13,000 per annum for the following four years and so on, increasing by k4,000 per annum every four years until the payment stream stops after income has been received for 20 years (ie 22 years after the initial outlay). At the point when the income ceases, the investment can be sold for K50,000. (a) Calculate the net present value of the project at a rate of interest of 9% per annum effective. [6 marks) (b) Explain the superiority of any other two named capital project appraisal methods in the above [2 marks] (ii) (a) Define a Eurobond and state any one advantage and one disadvantage to the issuer. [2 marks] (b) Distinguish between personal investment in residential property and investment shares of a listed property development company that has most of their assets in residential property. [3 marks) case. MTA/2020-p.3 (c) The rent for the next five years of an eighty-year property contract is set at K4,000 per month. Thereafter the rent will increase by 20% compound every five years. Determine the price to be paid for the contract in order to achieve a yield of 7% per annum effective. [3 marks) (ii) A fixed interest stock with a coupon of 8% per annum payable half-yearly in arrears can be redeemed at the option of the borrower at any time between 10 and 15 years from the date of issue. The stock is redeemable at par. What price should an investor subject to tax at 25% on income and capital gains, who wish to obtain a net yield of at least 7% per annum, pay for K100 nominal of this stock? [4 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts