Question: QUESTION TWO (17 MARKS) been asked to give advice on which is the better investment. The company's weighted One is to construct an office block

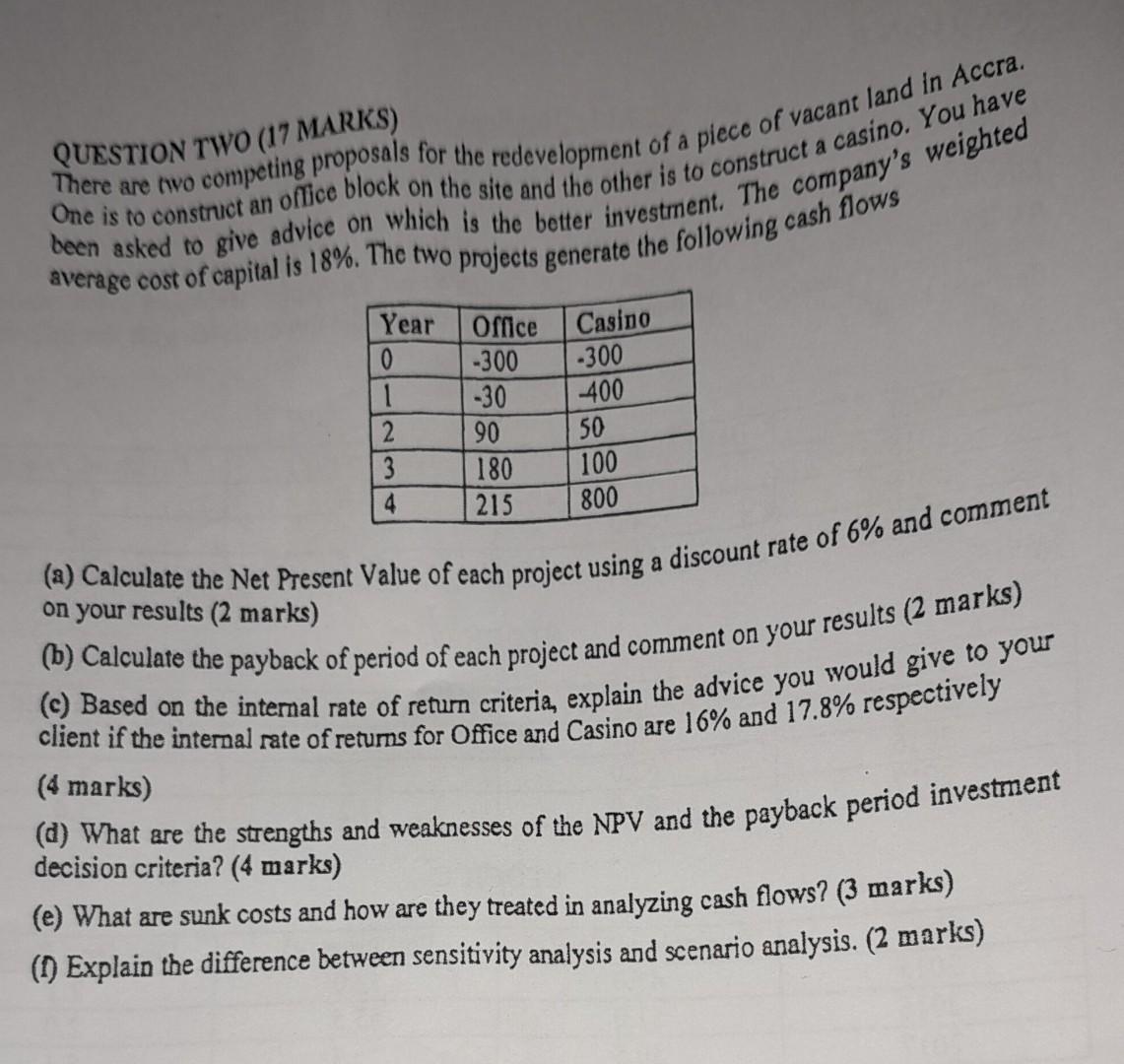

QUESTION TWO (17 MARKS) been asked to give advice on which is the better investment. The company's weighted One is to construct an office block on the site and the other is to construct a casino. You have There are two competing proposals for the redevelopment of a piece of vacant land in Accra. average cost of capital is 18%. The two projects generate the following cash flows Year Office Casino 0 -300 -300 1 -30 -400 2 90 50 3 180 100 4 215 800 (a) Calculate the Net Present Value of each project using a discount rate of 6% and comment on your results (2 marks) (b) Calculate the payback of period of each project and comment on your results (2 marks) client if the internal rate of returns for Office and Casino are 16% and 17.8% respectively (c) Based on the internal rate of return criteria, explain the advice you would give to your (4 marks) (d) What are the strengths and weaknesses of the NPV and the payback period investment decision criteria? (4 marks) (e) What are sunk costs and how are they treated in analyzing cash flows? (3 marks) (1) Explain the difference between sensitivity analysis and scenario analysis. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts