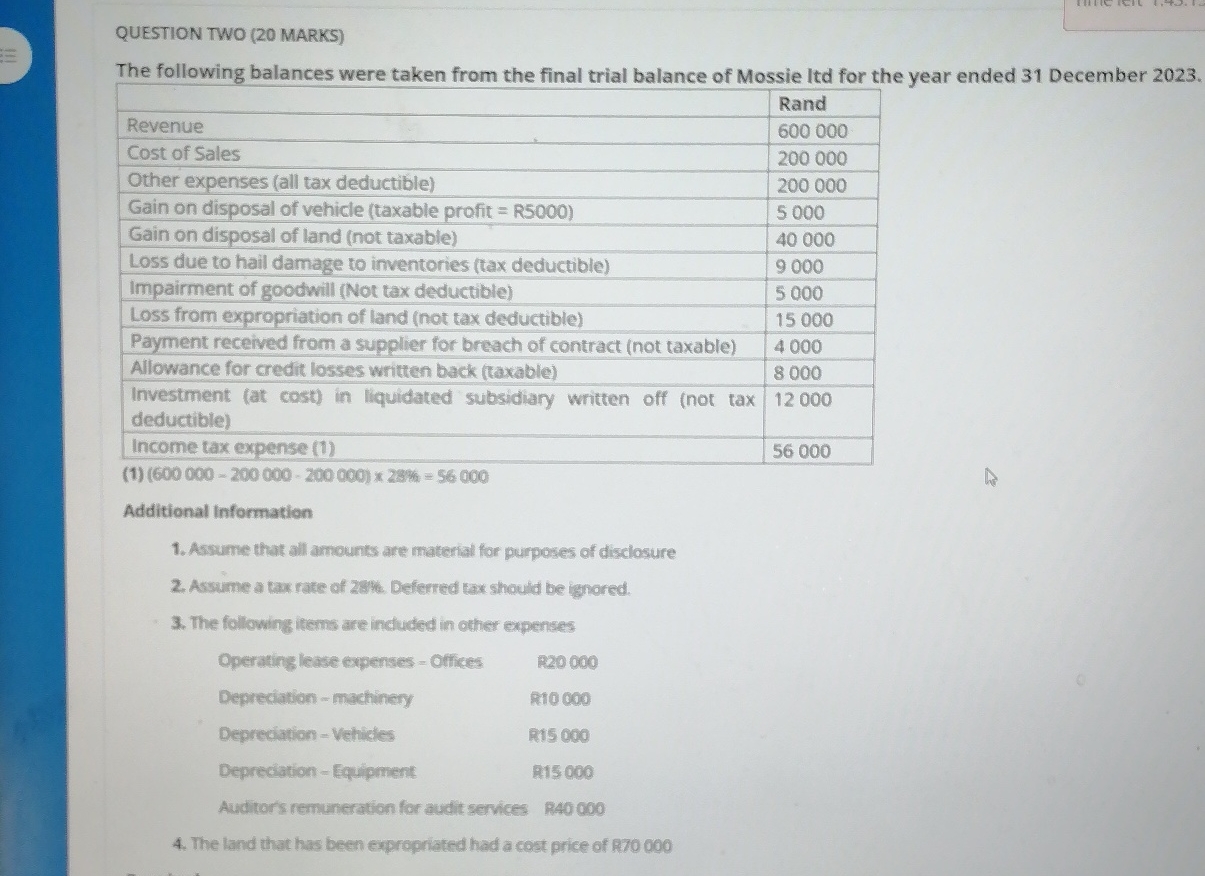

Question: QUESTION TWO ( 2 0 MARKS ) The following balances were taken from the final trial balance of Mossie Itd for the year ended 3

QUESTION TWO MARKS

The following balances were taken from the final trial balance of Mossie Itd for the year ended December

tableRandRevenueCost of Sales,Other expenses all tax deductibleGain on disposal of vehicle taxable profit RGain on disposal of land not taxableLoss due to hail damage to inventories tax deductibleImpairment of goodwill Not tax deductibleLoss from expropriation of land not tax deductiblePayment received from a supplier for breach of contract not taxableAllowance for credit losses written back taxableInvestment at cost in liquidated subsidiary written off not tax deductibleIncome tax expense

Additional Information

Assume that all amounts are material for purposes of disclosure

Assume a tax rate of Deferred tax should be ignored.

The following items are induded in other expenses

tableOperating lease expenses Offices,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock