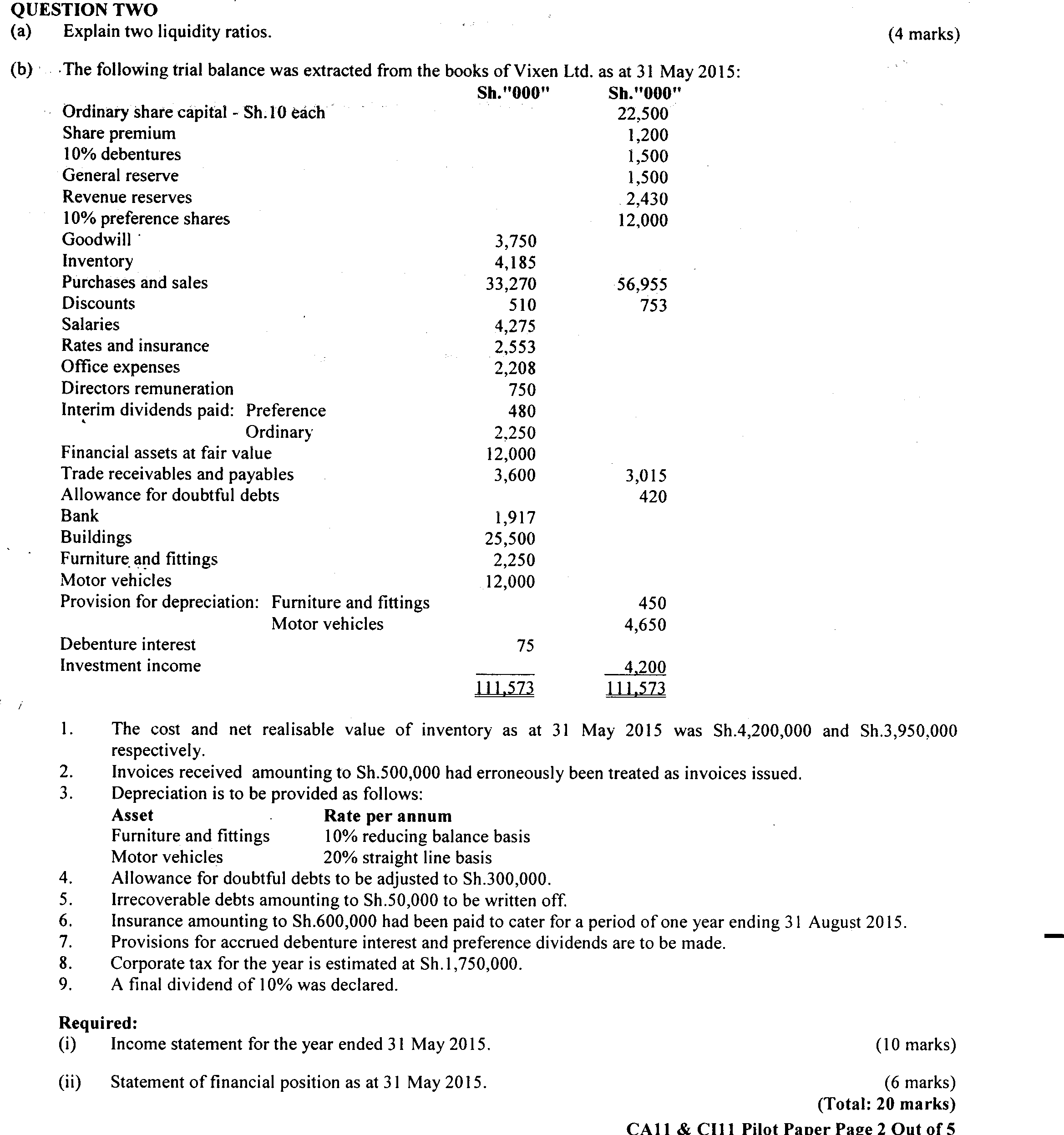

Question: QUESTION TWO (21) (b) ' Explain two liquidity ratios. ' 7 (4 marks) . The following trial balance was extracted from the books of Vixen

QUESTION TWO (21) (b) ' Explain two liquidity ratios. ' 7 (4 marks) . The following trial balance was extracted from the books of Vixen Ltd. as at 31 May 2015: Sh."000" Sh."000" ~ Ordinary share capital Sh.10 each ' ' ' 22,500 Share premium 1,200 10% debentures 1,500 General reserve I 1,500 Revenue reserves , 2,430 10% preference shares 12,000 Goodwill ' 3,750 Inventory 4,185 PUrchases and sales 33,270 56,955 Discounts 510 753 Salaries ' 4,275 Rates and insurance 2,553 Ofce expenses I 2,208 Directors remuneration 750 Interim dividends paid: Preference 480 ' Ordinary 2,250 Financial assets at fair value 12,000 Trade receivables and payables 3,600 3,015 Allowance for doubtful debts 420 Bank 1,917 Buildings 25,500 Furniture, and ttings 2,250 Motor vehicles 12,000 Provision for depreciation: Furniture and ttings 450 Motor vehicles 4,650 Debenture interest 75 Investment income 4,200 ALE M l. The cost and net realisable value of inventory as at 31 May 2015 was Sh.4,200,000 and Sh.3,950,000 respectively. 2. Invoices received amounting to Sh.500,000 had erroneously been treated as invoices issued. 3. Depreciation is to be provided as follows: Asset , Rate per annum Furniture and ttings 10% reducing balance basis Motor vehicles 20% straight line basis 4. Allowance for doubtful debts to be adjusted to Sh.300,000. 5. Irrecoverable debts amounting to Sh.50,000 to be written off. 6. Insurance amounting to Sh.600,000 had been paid to cater for a period ofone year ending 31 August 2015. 7. Provisions for accrued debenture interest and preference dividends are to be made. 8. Corporate tax for the year is estimated at Sh.l,750,000. 9. A nal dividend of 10% was declared. Required: (1) Income statement for the year ended 31 May 2015. (10 marks) (ii) Statement of nancial position as at 31 May 2015. (6 marks) (Total: 20 marks) CA1] & C111 Pilot Paper Page 2 Out of5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts