Question: QUESTION TWO (25 Marks) a. Using an example and a diagram explain the concept of dominance in portfolio (8 marks) b. An investor's portfolio consists

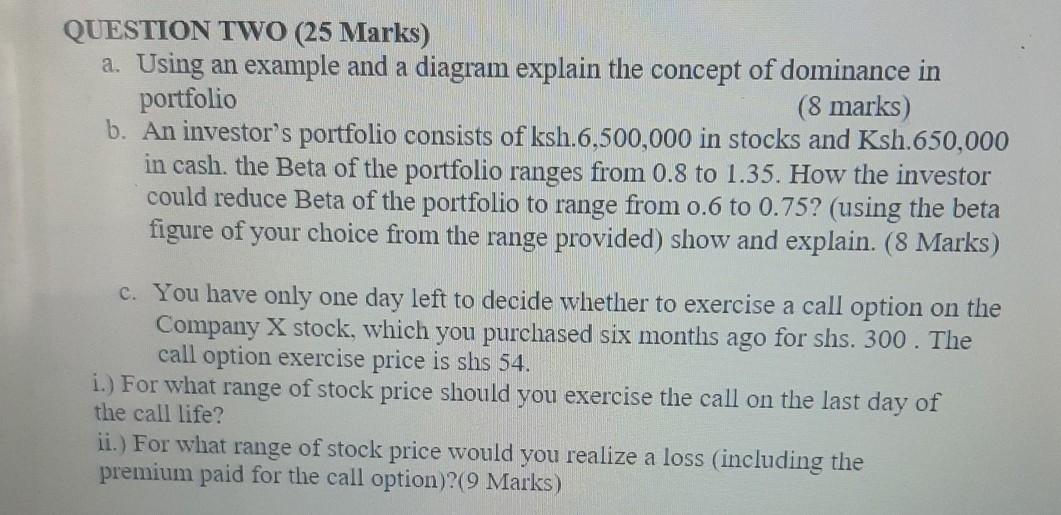

QUESTION TWO (25 Marks) a. Using an example and a diagram explain the concept of dominance in portfolio (8 marks) b. An investor's portfolio consists of ksh.6,500,000 in stocks and Ksh.650,000 in cash. the Beta of the portfolio ranges from 0.8 to 1.35. How the investor could reduce Beta of the portfolio to range from 0.6 to 0.75? (using the beta figure of your choice from the range provided) show and explain. (8 Marks) c. You have only one day left to decide whether to exercise a call option on the Company X stock, which you purchased six months ago for shs. 300. The call option exercise price is shs 54. i.) For what range of stock price should you exercise the call on the last day of the call life? ii.) For what range of stock price would you realize a loss (including the premium paid for the call option)?(9 Marks) QUESTION TWO (25 Marks) a. Using an example and a diagram explain the concept of dominance in portfolio (8 marks) b. An investor's portfolio consists of ksh.6,500,000 in stocks and Ksh.650,000 in cash. the Beta of the portfolio ranges from 0.8 to 1.35. How the investor could reduce Beta of the portfolio to range from 0.6 to 0.75? (using the beta figure of your choice from the range provided) show and explain. (8 Marks) c. You have only one day left to decide whether to exercise a call option on the Company X stock, which you purchased six months ago for shs. 300. The call option exercise price is shs 54. i.) For what range of stock price should you exercise the call on the last day of the call life? ii.) For what range of stock price would you realize a loss (including the premium paid for the call option)?(9 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts