Question: QUESTION TWO. (30 MARKS) A. Holding onto an asset can bring Monetary and non-monetary benefits. In relation to taking position in derivative contracts explain how

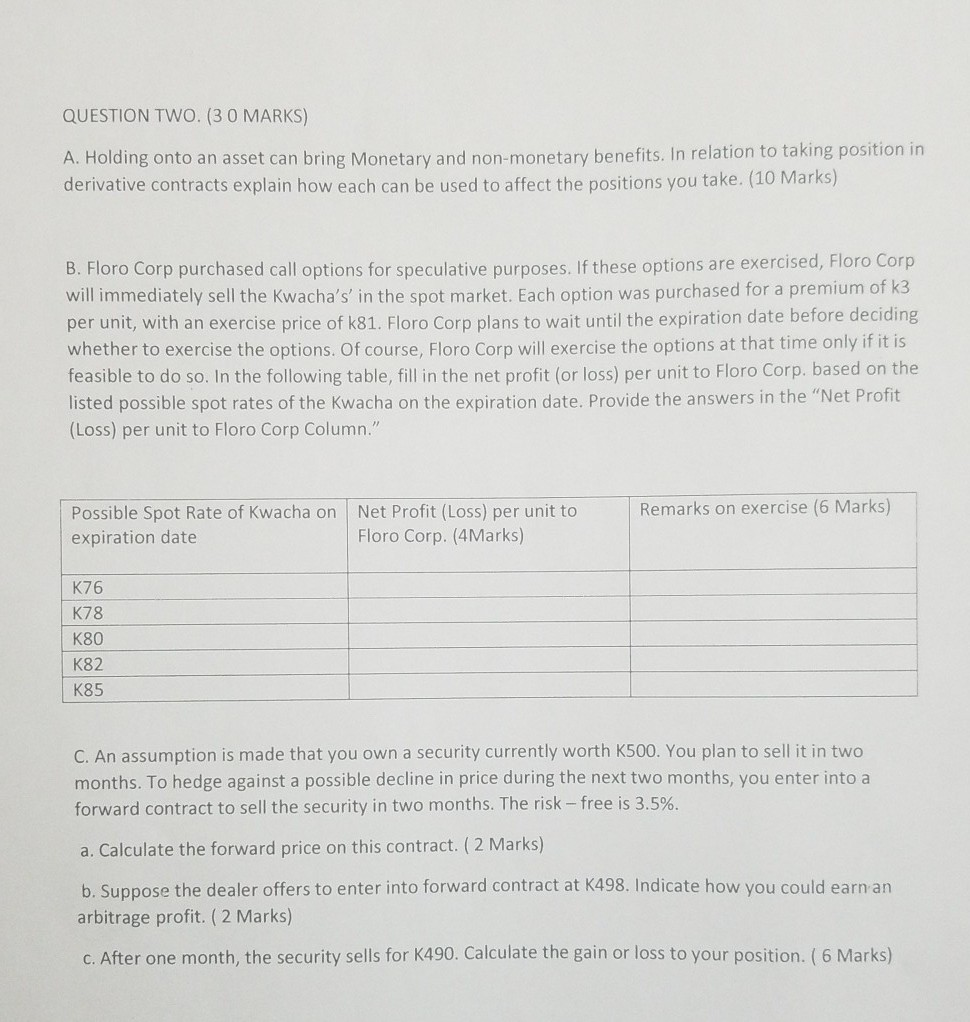

QUESTION TWO. (30 MARKS) A. Holding onto an asset can bring Monetary and non-monetary benefits. In relation to taking position in derivative contracts explain how each can be used to affect the positions you take. (10 Marks) B. Floro Corp purchased call options for speculative purposes. If these options are exercised, Floro Corp will immediately sell the Kwacha's' in the spot market. Each option was purchased for a premium of k3 per unit, with an exercise price of k81. Floro Corp plans to wait until the expiration date before deciding whether to exercise the options. Of course, Floro Corp will exercise the options at that time only if it is feasible to do so. In the following table, fill in the net profit (or loss) per unit to Floro Corp. based on the listed possible spot rates of the Kwacha on the expiration date. Provide the answers in the "Net Profit (Loss) per unit to Floro Corp Column." Remarks on exercise (6 Marks) Possible Spot Rate of Kwacha on expiration date Net Profit (Loss) per unit to Floro Corp. (4Marks) K76 K78 K80 K82 K85 C. An assumption is made that you own a security currently worth K500. You plan to sell it in two months. To hedge against a possible decline in price during the next two months, you enter into a forward contract to sell the security in two months. The risk - free is 3.5%. a. Calculate the forward price on this contract. ( 2 Marks) b. Suppose the dealer offers to enter into forward contract at K498. Indicate how you could earn an arbitrage profit. ( 2 Marks) c. After one month, the security sells for K490. Calculate the gain or loss to your position. ( 6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts