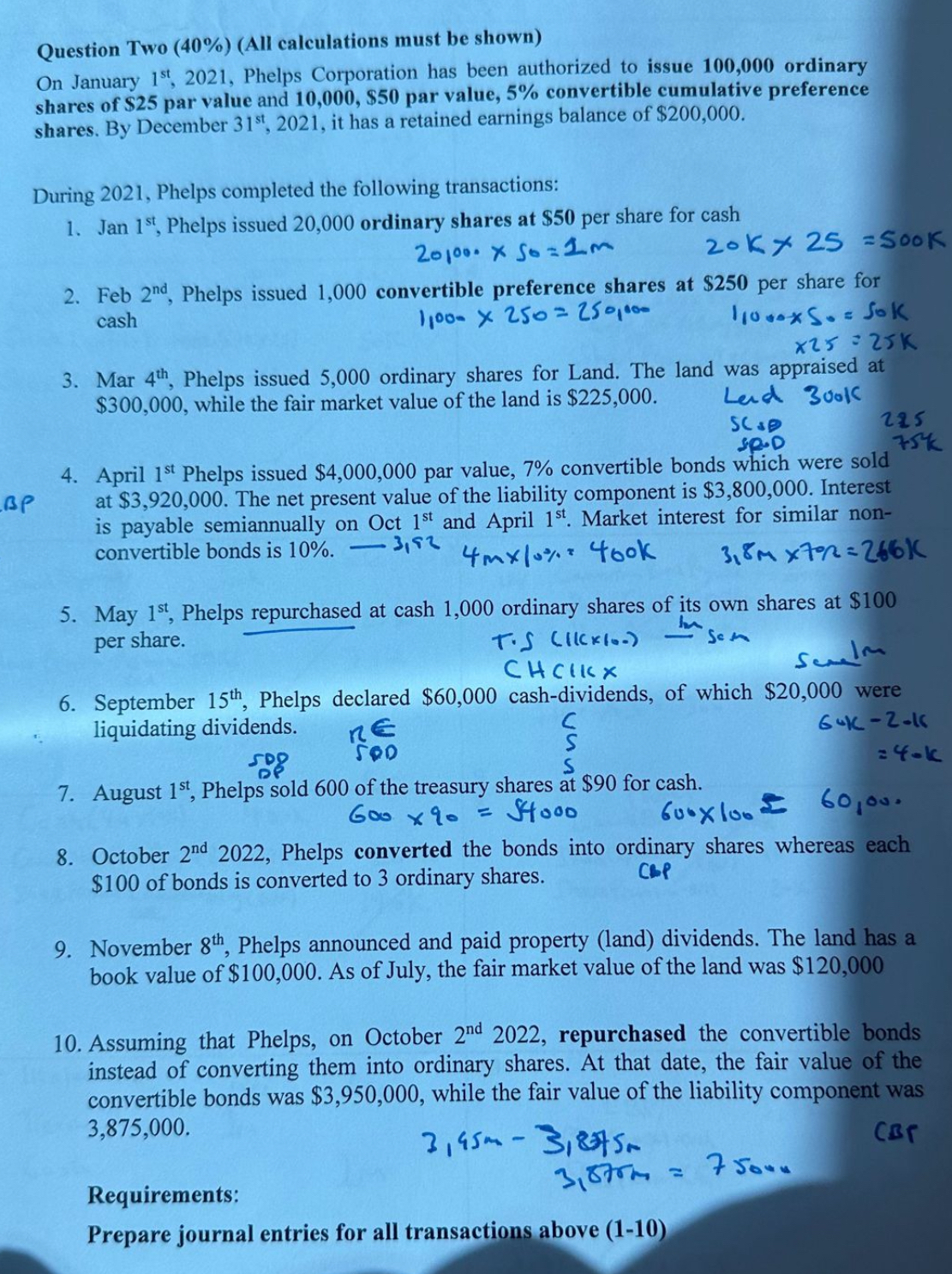

Question: Question Two ( 4 0 % ) ( All calculations must be shown ) On January 1 s t , 2 0 2 1 ,

Question Two All calculations must be shown

On January Phelps Corporation has been authorized to issue ordinary shares of $ par value and $ par value, convertible cumulative preference shares. By December it has a retained earnings balance of $

During Phelps completed the following transactions:

Jan Phelps issued ordinary shares at $ per share for cash

Feb Phelps issued convertible preference shares at $ per share for cash

Mar Phelps issued ordinary shares for Land. The land was appraised at $ while the fair market value of the land is $

Lend ool

Scso

spod

April Phelps issued $ par value, convertible bonds which were sold

at $ The net present value of the liability component is $ Interest is payable semiannually on Oct and April Market interest for similar nonconvertible bonds is

May Phelps repurchased at cash ordinary shares of its own shares at $ per share.

CHClk

sentm

September Phelps declared $ cashdividends, of which $ were liquidating dividends.

the treasury shares $ for cash.

October Phelps converted the bonds into ordinary shares whereas each $ of bonds is converted to ordinary shares.

Cb

November Phelps announced and paid property land dividends. The land has a book value of $ As of July, the fair market value of the land was $

Assuming that Phelps, on October repurchased the convertible bonds instead of converting them into ordinary shares. At that date, the fair value of the convertible bonds was $ while the fair value of the liability component was

Requirements:

CBr

Prepare journal entries for all transactions above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock