Question: Question Two (B) A five-year bond is issued with a face value of GHC3000.The bond pays coupon semiannually at 10%. The yield to maturity is

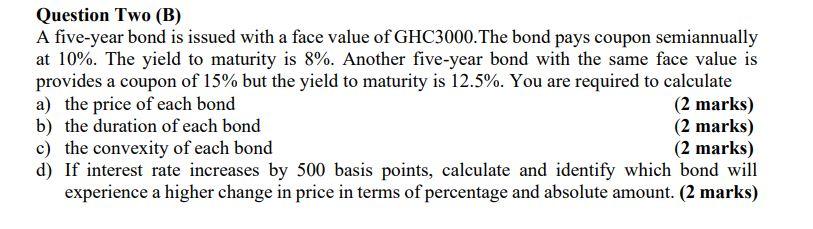

Question Two (B) A five-year bond is issued with a face value of GHC3000.The bond pays coupon semiannually at 10%. The yield to maturity is 8%. Another five-year bond with the same face value is provides a coupon of 15% but the yield to maturity is 12.5%. You are required to calculate a) the price of each bond (2 marks) b) the duration of each bond (2 marks) c) the convexity of each bond (2 marks) d) If interest rate increases by 500 basis points, calculate and identify which bond will experience a higher change in price in terms of percentage and absolute amount. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts