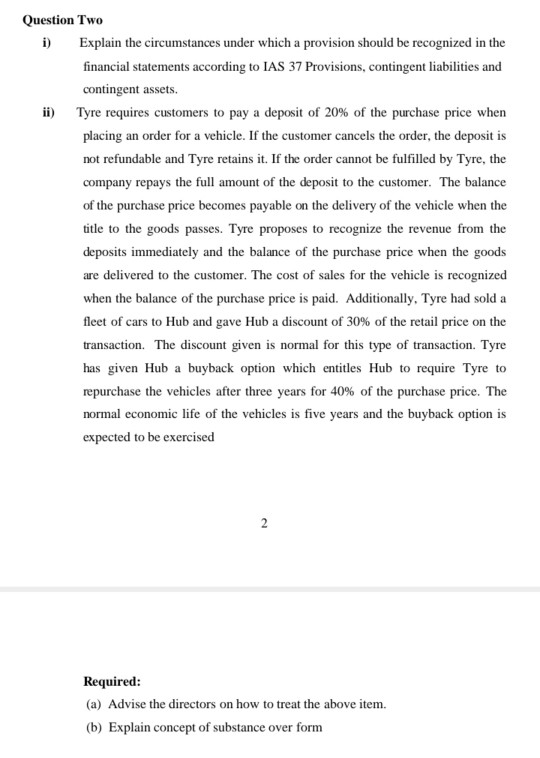

Question: Question Two i) Explain the circumstances under which a provision should be recognized in the financial statements according to IAS 37 Provisions, contingent liabilities and

Question Two i) Explain the circumstances under which a provision should be recognized in the financial statements according to IAS 37 Provisions, contingent liabilities and contingent assets. ii) Tyre requires customers to pay a deposit of 20% of the purchase price when placing an order for a vehicle. If the customer cancels the order, the deposit is not refundable and Tyre retains it. If the order cannot be fulfilled by Tyre, the company repays the full amount of the deposit to the customer. The balance of the purchase price becomes payable on the delivery of the vehicle when the title to the goods passes. Tyre proposes to recognize the revenue from the deposits immediately and the balance of the purchase price when the goods are delivered to the customer. The cost of sales for the vehicle is recognized when the balance of the purchase price is paid. Additionally, Tyre had sold a fleet of cars to Hub and gave Hub a discount of 30% of the retail price on the transaction. The discount given is normal for this type of transaction. Tyre has given Hub a buyback option which entitles Hub to require Tyre to repurchase the vehicles after three years for 40% of the purchase price. The normal economic life of the vehicles is five years and the buyback option is expected to be exercised 2 Required: (a) Advise the directors on how to treat the above item. (b) Explain concept of substance over form Question Two i) Explain the circumstances under which a provision should be recognized in the financial statements according to IAS 37 Provisions, contingent liabilities and contingent assets. ii) Tyre requires customers to pay a deposit of 20% of the purchase price when placing an order for a vehicle. If the customer cancels the order, the deposit is not refundable and Tyre retains it. If the order cannot be fulfilled by Tyre, the company repays the full amount of the deposit to the customer. The balance of the purchase price becomes payable on the delivery of the vehicle when the title to the goods passes. Tyre proposes to recognize the revenue from the deposits immediately and the balance of the purchase price when the goods are delivered to the customer. The cost of sales for the vehicle is recognized when the balance of the purchase price is paid. Additionally, Tyre had sold a fleet of cars to Hub and gave Hub a discount of 30% of the retail price on the transaction. The discount given is normal for this type of transaction. Tyre has given Hub a buyback option which entitles Hub to require Tyre to repurchase the vehicles after three years for 40% of the purchase price. The normal economic life of the vehicles is five years and the buyback option is expected to be exercised 2 Required: (a) Advise the directors on how to treat the above item. (b) Explain concept of substance over form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts