Question: QUESTION TWO John Smith is the sole shareholder and CEO of Able Manufacturing, Inc. Smith has put Able up for sale in advance of his

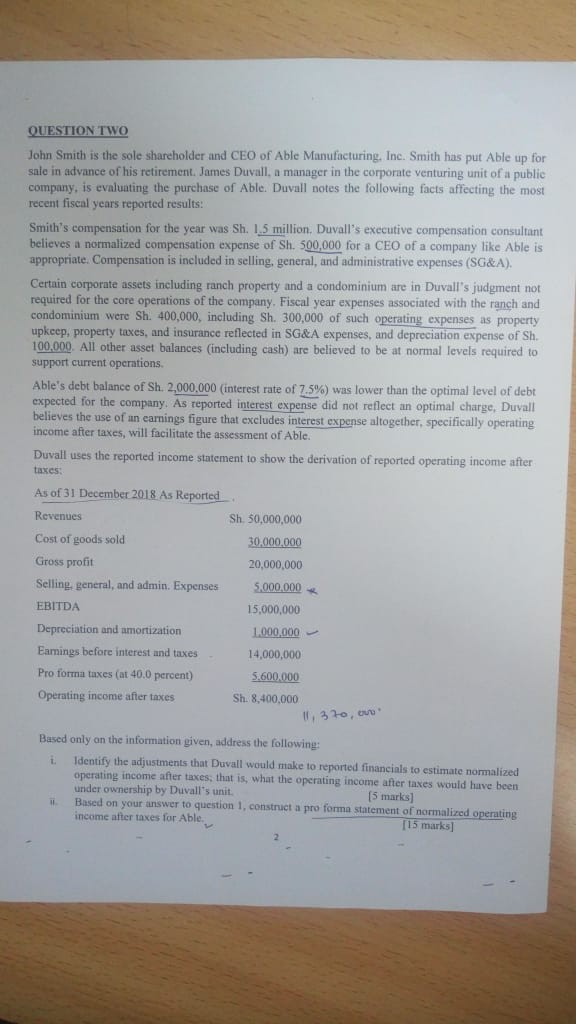

QUESTION TWO John Smith is the sole shareholder and CEO of Able Manufacturing, Inc. Smith has put Able up for sale in advance of his retirement. James Duvall, a manager in the corporate venturing unit of a public company, is evaluating the purchase of Able. Duvall notes the following facts affecting the most recent fiscal years reported results: Smith's compensation for the year was Sh. 1.5 million. Duvall's executive compensation consultant believes a normalized compensation expense of Sh. 500,000 for a CEO of a company like Able is appropriate. Compensation is included in selling, general, and administrative expenses (SG&A) Certain corporate assets including ranch property and a condominium are in Duvall's judgment not required for the core operations of the company. Fiscal year expenses associated with the ranch and condominium were Sh. 400,000, including Sh. 300,000 of such operating expenses as property upkeep, property taxes, and insurance reflected in SG&A expenses, and depreciation expense of Sh. 100,000. All other asset balances (including cash) are believed to be at normal levels required to support current operations Able's debt balance of Sh. 2,000,000 (interest rate of 7.5%) was lower than the optimal level of debt expected for the company. As reported interest expense did not reflect an optimal charge, Duvall believes the use of an earnings figure that excludes interest expense altogether, specifically operating income after taxes, will facilitate the assessment of Able. Duvall uses the reported income statement to show the derivation of reported operating income after taxes As of 31 December 2018 As Reported Revenues Sh 50,000,000 Cost of goods sold 30,000,000 Gross profit 20,000,000 Selling general, and admin. Expenses 5,000,000 EBITDA 15,000,000 Depreciation and amortization 1.000.000 Earnings before interest and taxes 14,000,000 Pro forma taxes (at 40.0 percent) 5.600.000 Operating income after taxes Sh. 8,400,000 11, 370, ovo Based only on the information given, address the following: Identify the adjustments that Duvall would make to reported financials to estimate normalized operating income after taxes, that is, what the operating income after taxes would have been under ownership by Duvall's unit. (5 marks] Based on your answer to question 1, construct a pro forma statement of normalized operating income after taxes for Able. [15 marks] QUESTION TWO John Smith is the sole shareholder and CEO of Able Manufacturing, Inc. Smith has put Able up for sale in advance of his retirement. James Duvall, a manager in the corporate venturing unit of a public company, is evaluating the purchase of Able. Duvall notes the following facts affecting the most recent fiscal years reported results: Smith's compensation for the year was Sh. 1.5 million. Duvall's executive compensation consultant believes a normalized compensation expense of Sh. 500,000 for a CEO of a company like Able is appropriate. Compensation is included in selling, general, and administrative expenses (SG&A) Certain corporate assets including ranch property and a condominium are in Duvall's judgment not required for the core operations of the company. Fiscal year expenses associated with the ranch and condominium were Sh. 400,000, including Sh. 300,000 of such operating expenses as property upkeep, property taxes, and insurance reflected in SG&A expenses, and depreciation expense of Sh. 100,000. All other asset balances (including cash) are believed to be at normal levels required to support current operations Able's debt balance of Sh. 2,000,000 (interest rate of 7.5%) was lower than the optimal level of debt expected for the company. As reported interest expense did not reflect an optimal charge, Duvall believes the use of an earnings figure that excludes interest expense altogether, specifically operating income after taxes, will facilitate the assessment of Able. Duvall uses the reported income statement to show the derivation of reported operating income after taxes As of 31 December 2018 As Reported Revenues Sh 50,000,000 Cost of goods sold 30,000,000 Gross profit 20,000,000 Selling general, and admin. Expenses 5,000,000 EBITDA 15,000,000 Depreciation and amortization 1.000.000 Earnings before interest and taxes 14,000,000 Pro forma taxes (at 40.0 percent) 5.600.000 Operating income after taxes Sh. 8,400,000 11, 370, ovo Based only on the information given, address the following: Identify the adjustments that Duvall would make to reported financials to estimate normalized operating income after taxes, that is, what the operating income after taxes would have been under ownership by Duvall's unit. (5 marks] Based on your answer to question 1, construct a pro forma statement of normalized operating income after taxes for Able. [15 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts