Question: Question Two Mrs Thando is employed by 1824 Ltd. as a salesman. He provided the following information relating to his income and that of his

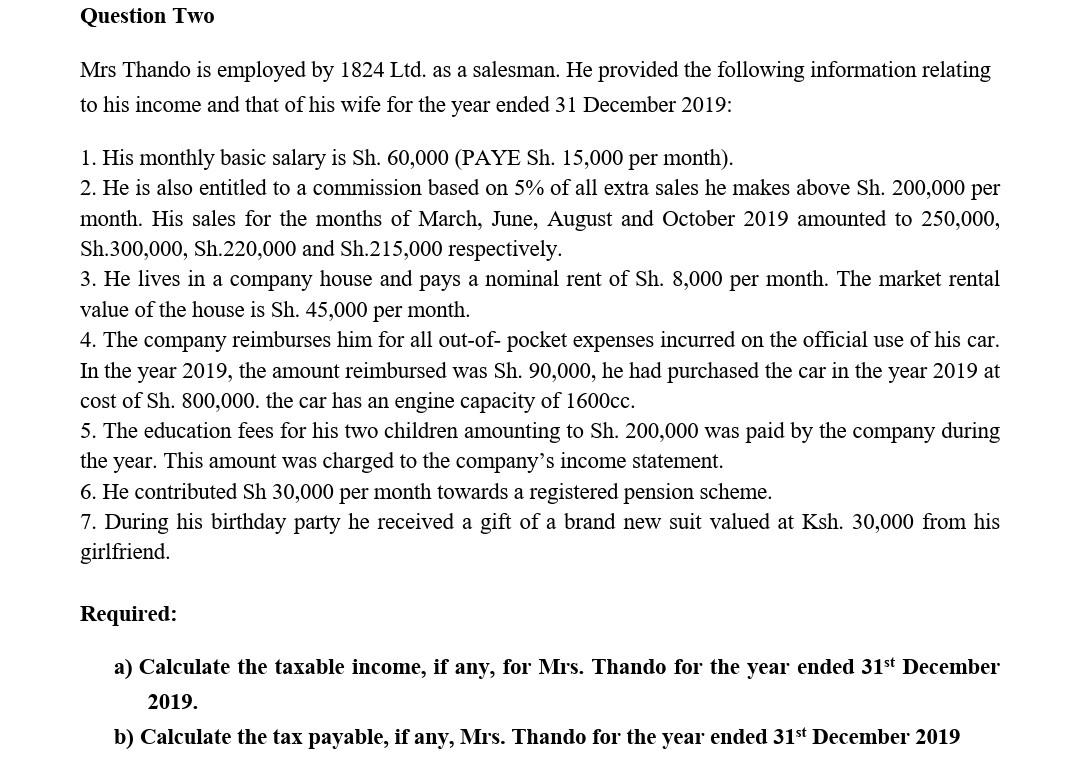

Question Two Mrs Thando is employed by 1824 Ltd. as a salesman. He provided the following information relating to his income and that of his wife for the year ended 31 December 2019: 1. His monthly basic salary is Sh. 60,000 (PAYE Sh. 15,000 per month). 2. He is also entitled to a commission based on 5% of all extra sales he makes above Sh. 200,000 per month. His sales for the months of March, June, August and October 2019 amounted to 250,000, Sh.300,000, Sh.220,000 and Sh.215,000 respectively. 3. He lives in a company house and pays a nominal rent of Sh. 8,000 per month. The market rental value of the house is Sh. 45,000 per month. 4. The company reimburses him for all out-of- pocket expenses incurred on the official use of his car. In the year 2019, the amount reimbursed was Sh. 90,000, he had purchased the car in the year 2019 at cost of Sh. 800,000. the car has an engine capacity of 1600cc. 5. The education fees for his two children amounting to Sh. 200,000 was paid by the company during the year. This amount was charged to the company's income statement. 6. He contributed Sh 30,000 per month towards a registered pension scheme. 7. During his birthday party he received a gift of a brand new suit valued at Ksh. 30,000 from his girlfriend. Required: a) Calculate the taxable income, if any, for Mrs. Thando for the year ended 31st December 2019. b) Calculate the tax payable, if any, Mrs. Thando for the year ended 31st December 2019 Question Two Mrs Thando is employed by 1824 Ltd. as a salesman. He provided the following information relating to his income and that of his wife for the year ended 31 December 2019: 1. His monthly basic salary is Sh. 60,000 (PAYE Sh. 15,000 per month). 2. He is also entitled to a commission based on 5% of all extra sales he makes above Sh. 200,000 per month. His sales for the months of March, June, August and October 2019 amounted to 250,000, Sh.300,000, Sh.220,000 and Sh.215,000 respectively. 3. He lives in a company house and pays a nominal rent of Sh. 8,000 per month. The market rental value of the house is Sh. 45,000 per month. 4. The company reimburses him for all out-of- pocket expenses incurred on the official use of his car. In the year 2019, the amount reimbursed was Sh. 90,000, he had purchased the car in the year 2019 at cost of Sh. 800,000. the car has an engine capacity of 1600cc. 5. The education fees for his two children amounting to Sh. 200,000 was paid by the company during the year. This amount was charged to the company's income statement. 6. He contributed Sh 30,000 per month towards a registered pension scheme. 7. During his birthday party he received a gift of a brand new suit valued at Ksh. 30,000 from his girlfriend. Required: a) Calculate the taxable income, if any, for Mrs. Thando for the year ended 31st December 2019. b) Calculate the tax payable, if any, Mrs. Thando for the year ended 31st December 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts