Question: Question two Prepare suitable entries for the following cases: Case one a- On June 1. S. Tom invested $ 95,000 cash and office equipment valued

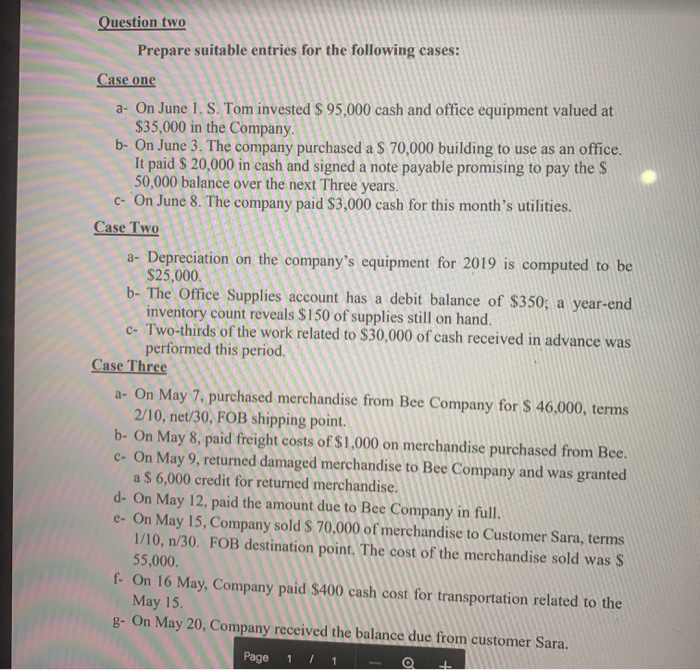

Question two Prepare suitable entries for the following cases: Case one a- On June 1. S. Tom invested $ 95,000 cash and office equipment valued at $35,000 in the Company. b- On June 3. The company purchased a $ 70,000 building to use as an office. It paid $ 20,000 in cash and signed a note payable promising to pay the $ 50,000 balance over the next Three years. c- 'On June 8. The company paid $3,000 cash for this month's utilities. Case Two a- Depreciation on the company's equipment for 2019 is computed to be $25,000 b- The Office Supplies account has a debit balance of $350; a year-end inventory count reveals $150 of supplies still on hand. c- Two-thirds of the work related to $30,000 of cash received in advance was performed this period. Case Three 2- On May 7, purchased merchandise from Bee Company for $ 46,000, terms 2/10, net/30, FOB shipping point. b- On May 8, paid freight costs of $1,000 on merchandise purchased from Bee. C- On May 9, returned damaged merchandise to Bee Company and was granted a $ 6,000 credit for returned merchandise. d-On May 12, paid the amount due to Bee Company in full. e-On May 15, Company sold $ 70,000 of merchandise to Customer Sara, terms 1/10, n/30. FOB destination point. The cost of the merchandise sold was $ 55,000. f. On 16 May, Company paid $400 cash cost for transportation related to the May 15. g- On May 20, Company received the balance due from customer Sara. Page 1 / 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts