Question: QUESTION TWO Sbusiso Ndlovu ( aged 4 5 ) , a resident of South Africa without a disability, earns a basic monthly salary of R

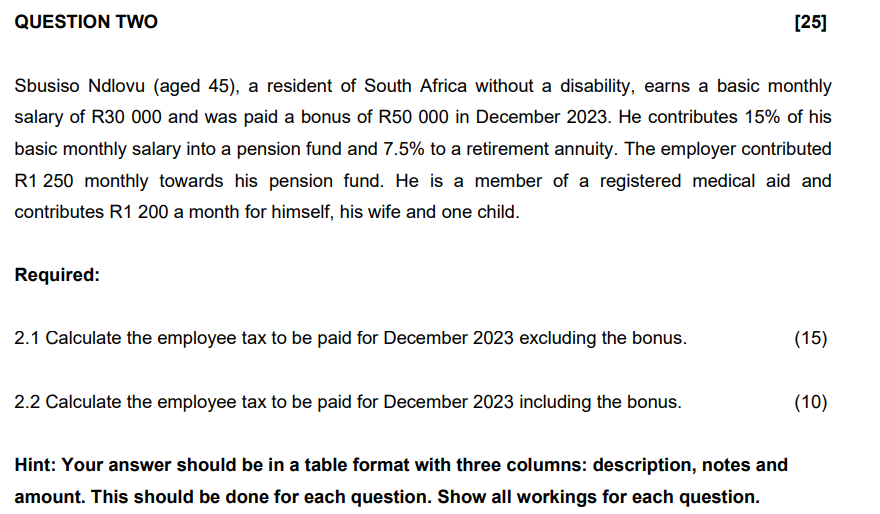

QUESTION TWO

Sbusiso Ndlovu aged a resident of South Africa without a disability, earns a basic monthly salary of R and was paid a bonus of R in December He contributes of his basic monthly salary into a pension fund and to a retirement annuity. The employer contributed R monthly towards his pension fund. He is a member of a registered medical aid and contributes R a month for himself, his wife and one child.

Required:

Calculate the employee tax to be paid for December excluding the bonus.

Calculate the employee tax to be paid for December including the bonus.

Hint: Your answer should be in a table format with three columns: description, notes and amount. This should be done for each question. Show all workings for each question.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock