Question: QUESTION TWO SECTIONS (B) There are three questions. Attempt any two questions. A) A company has issued 7% convertible bonds which are due to be

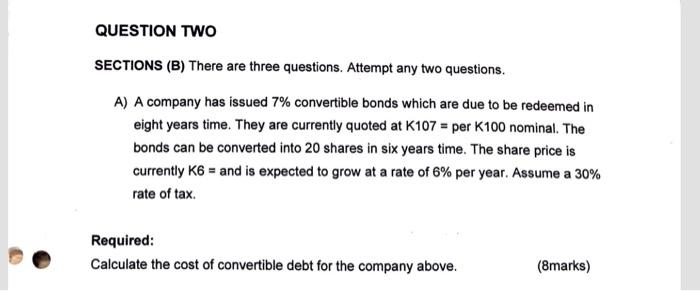

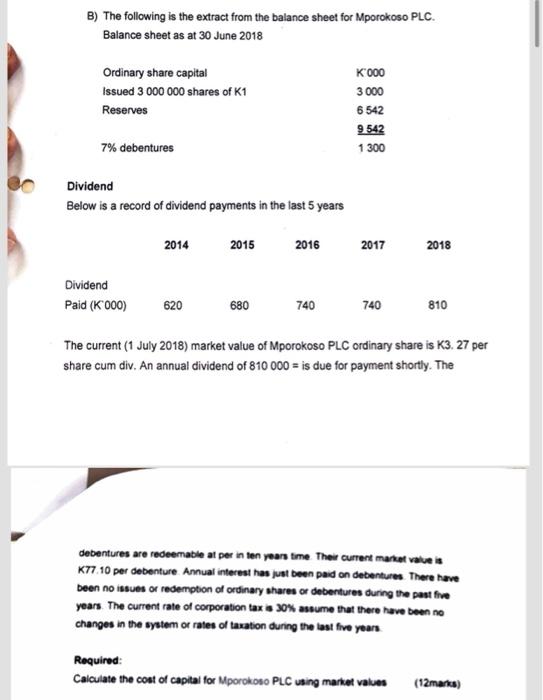

QUESTION TWO SECTIONS (B) There are three questions. Attempt any two questions. A) A company has issued 7% convertible bonds which are due to be redeemed in eight years time. They are currently quoted at K107 = per K100 nominal. The bonds can be converted into 20 shares in six years time. The share price is currently K6 = and is expected to grow at a rate of 6% per year. Assume a 30% rate of tax Required: Calculate the cost of convertible debt for the company above. (8marks) B) The following is the extract from the balance sheet for Mporokoso PLC. Balance sheet as at 30 June 2018 Ordinary share capital Issued 3 000 000 shares of K1 Reserves K 000 3 000 6542 9 542 1 300 7% debentures Dividend Below is a record of dividend payments in the last 5 years 2014 2015 2016 2017 2018 Dividend Paid (K 000) 620 680 740 740 810 The current (1 July 2018) market value of Mporokoso PLC ordinary share is K3. 27 per share cum div. An annual dividend of 810 000 = is due for payment shortly. The debentures are redeemable at per in ten years time. The current market value is K77 10 per debenture Annual interest has just been paid on debentures There have been no issues or redemption of ordinary shares or debentures during the past five years. The current rate of corporation tax is 30% assume that there have been ne changes in the system or rates of taxation during the last five years Required: Calculate the cost of capital for Mporokoro PLC using market values (12mans) QUESTION TWO SECTIONS (B) There are three questions. Attempt any two questions. A) A company has issued 7% convertible bonds which are due to be redeemed in eight years time. They are currently quoted at K107 = per K100 nominal. The bonds can be converted into 20 shares in six years time. The share price is currently K6 = and is expected to grow at a rate of 6% per year. Assume a 30% rate of tax Required: Calculate the cost of convertible debt for the company above. (8marks) B) The following is the extract from the balance sheet for Mporokoso PLC. Balance sheet as at 30 June 2018 Ordinary share capital Issued 3 000 000 shares of K1 Reserves K 000 3 000 6542 9 542 1 300 7% debentures Dividend Below is a record of dividend payments in the last 5 years 2014 2015 2016 2017 2018 Dividend Paid (K 000) 620 680 740 740 810 The current (1 July 2018) market value of Mporokoso PLC ordinary share is K3. 27 per share cum div. An annual dividend of 810 000 = is due for payment shortly. The debentures are redeemable at per in ten years time. The current market value is K77 10 per debenture Annual interest has just been paid on debentures There have been no issues or redemption of ordinary shares or debentures during the past five years. The current rate of corporation tax is 30% assume that there have been ne changes in the system or rates of taxation during the last five years Required: Calculate the cost of capital for Mporokoro PLC using market values (12mans)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts