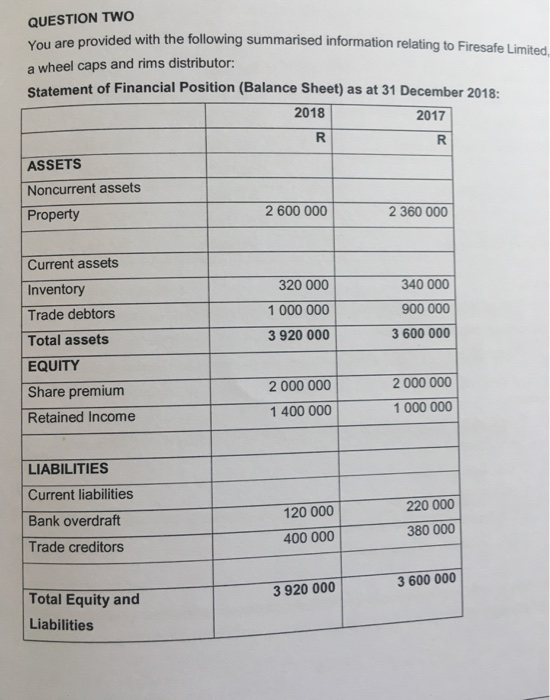

Question: QUESTION TWO You are provided with the following summa provided with the following summarised information relating to Firesafe Limited. a wheel caps and rims distributor:

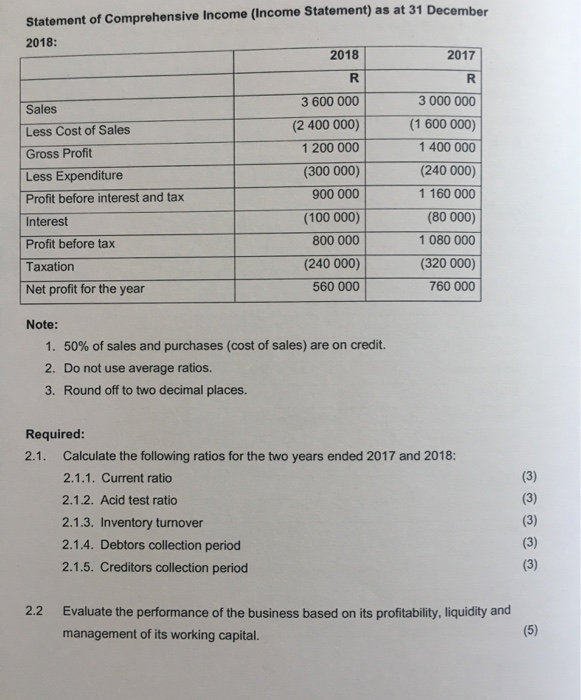

QUESTION TWO You are provided with the following summa provided with the following summarised information relating to Firesafe Limited. a wheel caps and rims distributor: Statement of Financial Position (Balance Sheet) as at 31 December 2018: 2018 2017 DR R ASSETS Noncurrent assets Property 2 600 000 2360 000 Current assets Inventory Trade debtors Total assets EQUITY Share premium Retained Income 320 000 1 000 000 3 920 000 340 000 900 000 3 600 000 2 000 000 1 400 000 2 000 000 1 000 000 LIABILITIES Current liabilities Bank overdraft Trade creditors 120 000 400 000 220 000 380 000 3 920 000 3 600 000 Total Equity and Liabilities Statement of Comprehensive Income (Income Statement) as at 31 December 2018: 2018 2017 Sales Less Cost of Sales Gross Profit Less Expenditure Profit before interest and tax Interest Profit before tax Taxation Net profit for the year 3 600 000 (2 400 000) 1 200 000 (300 000) 900 000 (100 000) 800 000 (240 000) 560 000 3 000 000 (1 600 000) 1 400 000 (240 000) 1 160 000 (80 000) 1 080 000 (320 000) 760 000 Note: 1. 50% of sales and purchases (cost of sales) are on credit. 2. Do not use average ratios. 3. Round off to two decimal places. Required: 2.1. Calculate the following ratios for the two years ended 2017 and 2018: 2.1.1. Current ratio 2.1.2. Acid test ratio 2.1.3. Inventory turnover 2.1.4. Debtors collection period 2.1.5. Creditors collection period Evaluate the performance of the business based on its profitability, liquidity and management of its working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts