Question: QUESTION TWO-BONDS VALUATION (11 Marks) Sonia bought a bond when it was issued by ABC Ltd 14 years ago. The bond which has a S

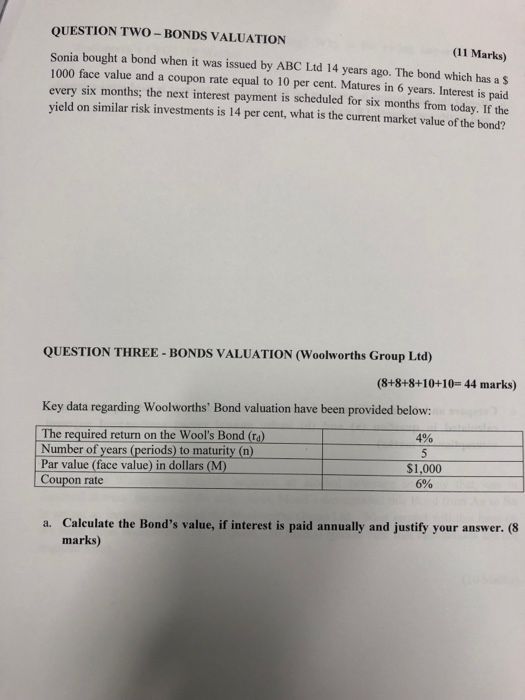

QUESTION TWO-BONDS VALUATION (11 Marks) Sonia bought a bond when it was issued by ABC Ltd 14 years ago. The bond which has a S 1000 face value and a coupon rate equal to 10 per cent. Matures in 6 years. Interest is paid every six months; the next interest payment is scheduled for six months from today. If the yield on similar risk investments is 14 per cent, what is the current market value of the bond? QUESTION THREE-BONDS VALUATION (Woolworths Group Ltd) (8+8+8+10+10-44 marks) Key data regarding Woolworths' Bond valuation have been provided below: The required return on the Wool's Bond (Ca) Number of years (periods) to maturity (n) Par value (face value) in dollars (M) Coupon rate 490 $1,000 8% a. Caleulate the Bond's value, if interest is paid annually and justify your answer. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts