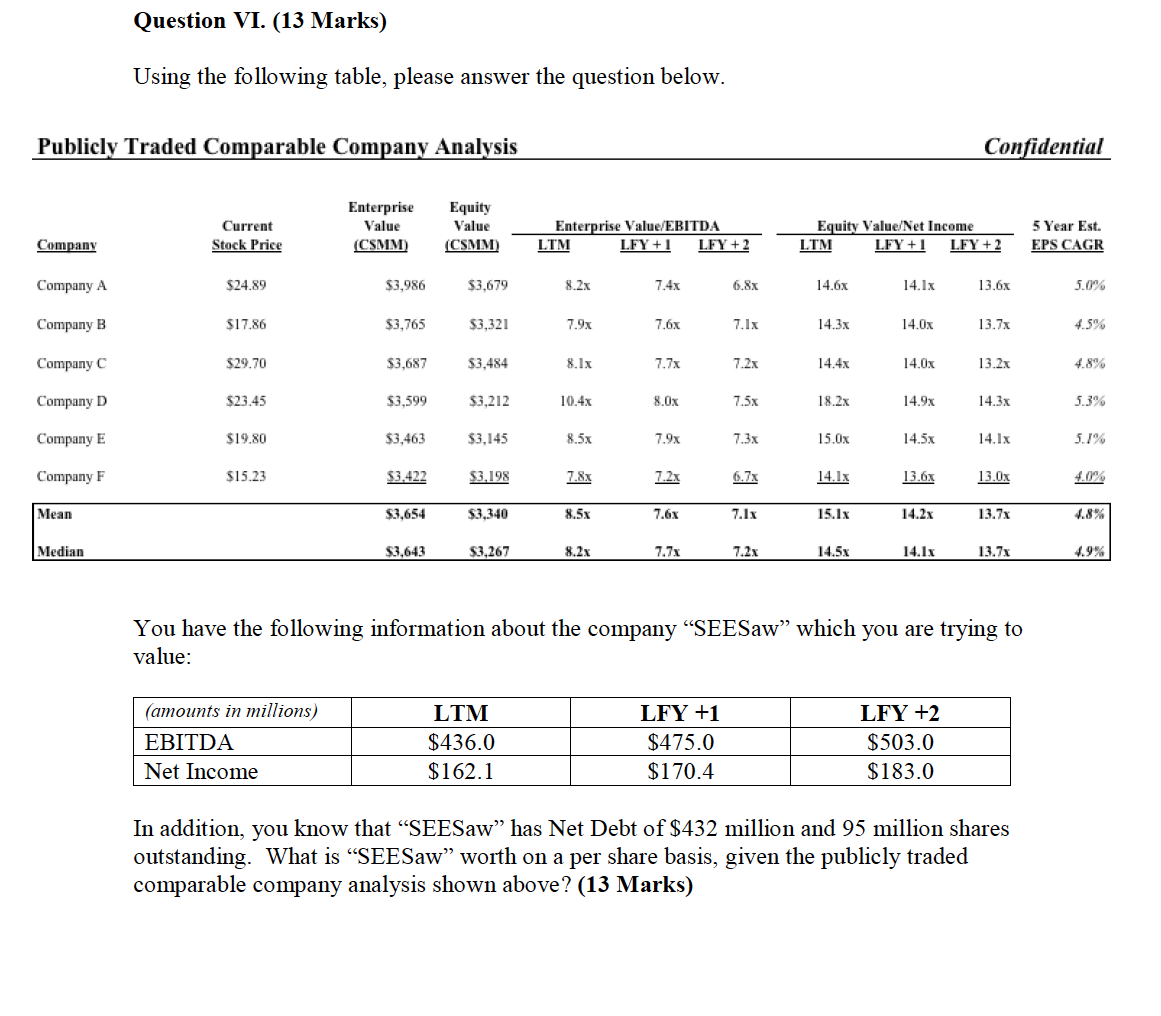

Question: Question VI. (13 Marks) Using the following table, please answer the question below. Publicly Traded Comparable Company Analysis Confidential Enterprise Value Current Stock Price Equity

Question VI. (13 Marks) Using the following table, please answer the question below. Publicly Traded Comparable Company Analysis Confidential Enterprise Value Current Stock Price Equity Value (CSMM) Enterprise Value/EBITDA LTM LFY + 1 LFY + 2 Equity Value/Net Income LTM LFY +1 LFY + 2 5 Year Est. EPS CAGR Company (CSMM) Company A $24.89 $3,986 $3,679 8.2x 7.4x 6.8x 14.6x 14.Ix 13.6x 5.0% Company B $17.86 $3,765 $3,321 7.9x 7.6x 7. Ix 14.3x 14.0x 13.7x 4.5% Company C $29.70 $3,687 $3,484 8.IX 7.7x 7.2x 14.4% 14.0x 13.2x Company D $23.45 $3,599 $3,212 10.4x 8.Ox 7.5x 18.2x 14.9x 14.3x 5.3% Company E $19.80 $3,463 $3,145 8.5x 7.9x 7.3x 15.0x 14.5x 14.1x 5.1% Company F $15.23 $3,422 $3.198 7.8% 7.2x 6.7x 14.1x 13.6% 13.0x Mean $3,654 $3,340 8.5x 7.6% 7.1x 15.1x 14.2x 13.7% 4.8% Median $3,643 $3,267 8.2x 7.7x 7.2x 14.5x 14.1x 13.7x 4.9% You have the following information about the company SEESaw which you are trying to value: (amounts in millions) EBITDA Net Income LTM $436.0 $162.1 LFY +1 $475.0 $170.4 LFY +2 $503.0 $183.0 In addition, you know that "SEESaw has Net Debt of $432 million and 95 million shares outstanding. What is SEESaw worth on a per share basis, given the publicly traded comparable company analysis shown above? (13 Marks) Question VI. (13 Marks) Using the following table, please answer the question below. Publicly Traded Comparable Company Analysis Confidential Enterprise Value Current Stock Price Equity Value (CSMM) Enterprise Value/EBITDA LTM LFY + 1 LFY + 2 Equity Value/Net Income LTM LFY +1 LFY + 2 5 Year Est. EPS CAGR Company (CSMM) Company A $24.89 $3,986 $3,679 8.2x 7.4x 6.8x 14.6x 14.Ix 13.6x 5.0% Company B $17.86 $3,765 $3,321 7.9x 7.6x 7. Ix 14.3x 14.0x 13.7x 4.5% Company C $29.70 $3,687 $3,484 8.IX 7.7x 7.2x 14.4% 14.0x 13.2x Company D $23.45 $3,599 $3,212 10.4x 8.Ox 7.5x 18.2x 14.9x 14.3x 5.3% Company E $19.80 $3,463 $3,145 8.5x 7.9x 7.3x 15.0x 14.5x 14.1x 5.1% Company F $15.23 $3,422 $3.198 7.8% 7.2x 6.7x 14.1x 13.6% 13.0x Mean $3,654 $3,340 8.5x 7.6% 7.1x 15.1x 14.2x 13.7% 4.8% Median $3,643 $3,267 8.2x 7.7x 7.2x 14.5x 14.1x 13.7x 4.9% You have the following information about the company SEESaw which you are trying to value: (amounts in millions) EBITDA Net Income LTM $436.0 $162.1 LFY +1 $475.0 $170.4 LFY +2 $503.0 $183.0 In addition, you know that "SEESaw has Net Debt of $432 million and 95 million shares outstanding. What is SEESaw worth on a per share basis, given the publicly traded comparable company analysis shown above? (13 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts