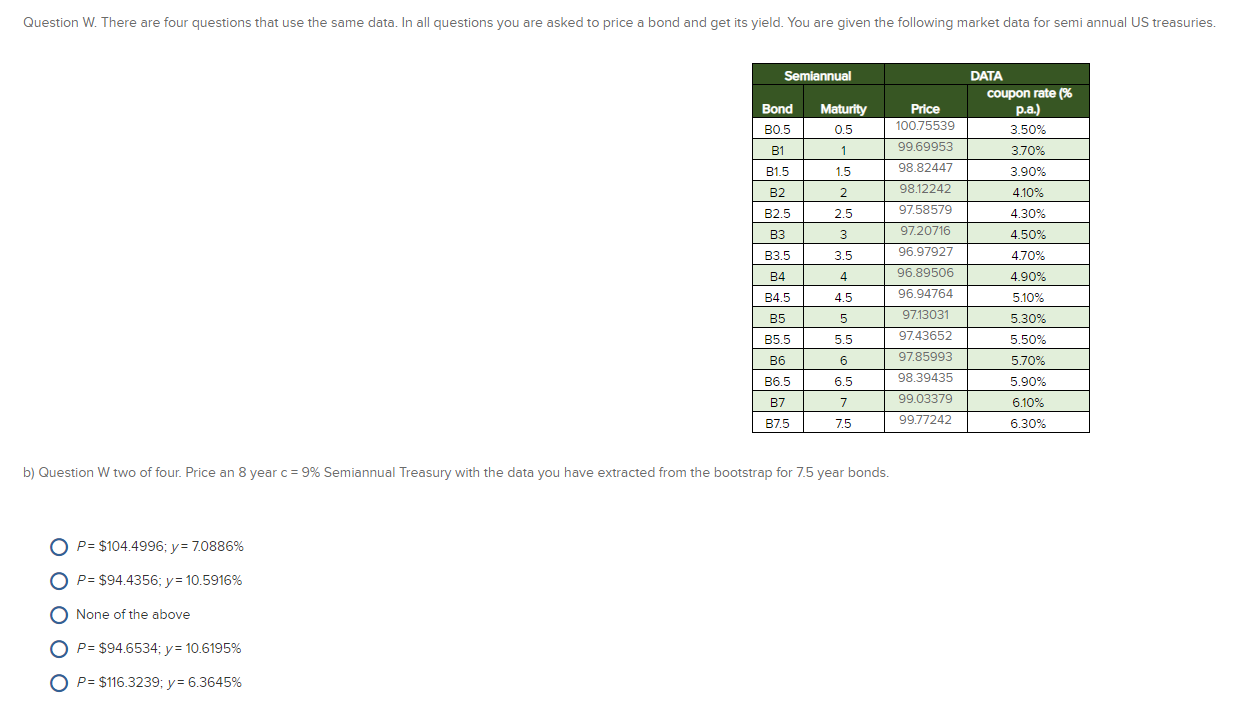

Question: Question W. There are four questions that use the same data. In all questions you are asked to price a bond and get its yield.

Question W. There are four questions that use the same data. In all questions you are asked to price a bond and get its yield. You are given the following market data for semi annual US treasuries. Semiannual DATA Bond B0.5 B1 B1.5 B2 B2.5 B3 B3.5 B4 B4.5 Maturity 0.5 1 1.5 2 2.5 3 3.5 Price 100.75539 99.69953 98.82447 98.12242 97.58579 97.20716 96.97927 96.89506 96.94764 97.13031 97.43652 97.85993 98.39435 99.03379 99.77242 coupon rate (% p.a.) 3.50% 3.70% 3.90% 4.10% 4.30% 4.50% 4.70% 4.90% 5.10% 5.30% 5.50% 5.70% 5.90% 6.10% 6.30% 4.5 B5 5.5 B5.5 B6 B6.5 B7 37.5 6.5 7.5 b) Question W two of four. Price an 8 year c= 9% Semiannual Treasury with the data you have extracted from the bootstrap for 7.5 year bonds. OP= $104.4996;y= 7.0886% O P= $94.4356; y = 10.5916% O None of the above O P= $94.6534; y= 10.6195% O P = $116.3239; y=6.3645% Question W. There are four questions that use the same data. In all questions you are asked to price a bond and get its yield. You are given the following market data for semi annual US treasuries. Semiannual DATA Bond B0.5 B1 B1.5 B2 B2.5 B3 B3.5 B4 B4.5 Maturity 0.5 1 1.5 2 2.5 3 3.5 Price 100.75539 99.69953 98.82447 98.12242 97.58579 97.20716 96.97927 96.89506 96.94764 97.13031 97.43652 97.85993 98.39435 99.03379 99.77242 coupon rate (% p.a.) 3.50% 3.70% 3.90% 4.10% 4.30% 4.50% 4.70% 4.90% 5.10% 5.30% 5.50% 5.70% 5.90% 6.10% 6.30% 4.5 B5 5.5 B5.5 B6 B6.5 B7 37.5 6.5 7.5 b) Question W two of four. Price an 8 year c= 9% Semiannual Treasury with the data you have extracted from the bootstrap for 7.5 year bonds. OP= $104.4996;y= 7.0886% O P= $94.4356; y = 10.5916% O None of the above O P= $94.6534; y= 10.6195% O P = $116.3239; y=6.3645%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts