Question: QUESTION: What is the portfolio standard deviation if you decide to allocate 30% of your investment in stock A and 70% in stock B, given

QUESTION:

What is the portfolio standard deviation if you decide to allocate 30% of your investment in stock A and 70% in stock B, given the correlation between stock A and B is -0.25?

References:

QUESTION:

What is the portfolio standard deviation if you decide to allocate 30% of your investment in stock A and 70% in stock B, given the correlation between stock A and B is -0.25?

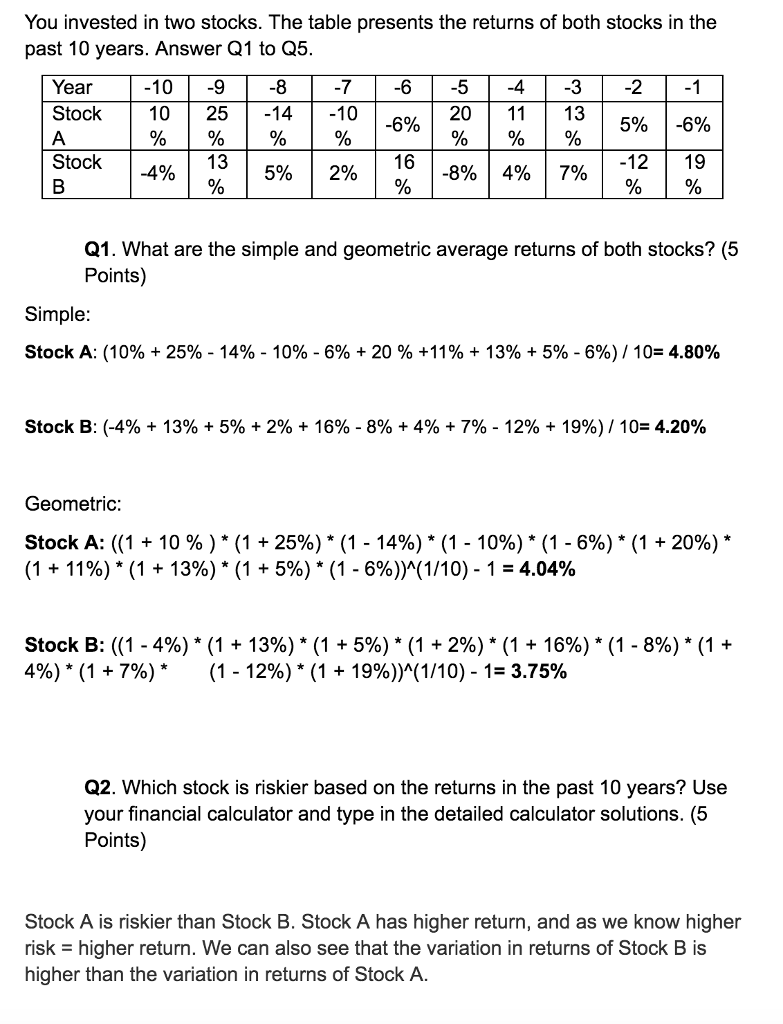

You invested in two stocks. The table presents the returns of both stocks in the past 10 years. Answer Q1 to Q5. 7-65 31 Year Stock 10 -9-8 10 251410 20 113 5% |-6% 1-6% .113 | 590 | 290 | 90 0, Stock- 1-4% 12 19 -8% | 4% | 7% | - | , Q1. VWhat are the simple and geometric average returns of both stocks? (5 Points) Simple Stock A. (10% + 25%-14%-10%-6% + 20 % +11% + 13% + 5%-6%) / 10= 4.80% Stock B: (-4% + 13% + 5% + 2% + 16%-8% + 4% 7%-12% + 19%) / 10-4.20% Geometric Stock A: ((1 + 10 % ) * (1 + 25%) * (1-14%) * (1-10%) * (1-6%) * (1 + 20%) * (1 + 11%) * (1 + 13%) * (1 + 5%) * (1-6%))^(1/10)-1 = 4.04% Stock B: ((1-4%) * (1 + 13%) * (1 + 5%) * (1 + 296) * (1 + 16%) * (1-8%) * (1 + 4%) * (1 + 7%) * (1-12%) * (1 + 19%))^(1 /10)-1-375% Q2. Which stock is riskier based on the returns in the past 10 years? Use your financial calculator and type in the detailed calculator solutions. (5 Points) Stock A is riskier than Stock B. Stock A has higher return, and as we know higher risk - higher return. We can also see that the variation in returns of Stock B is higher than the variation in returns of Stock A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts