Question: Question: What items and amounts does Tony report on this income tax return related to the Tall Ladders partnership for 2019? At the end of

Question: What items and amounts does Tony report on this income tax return related to the Tall Ladders partnership for 2019?

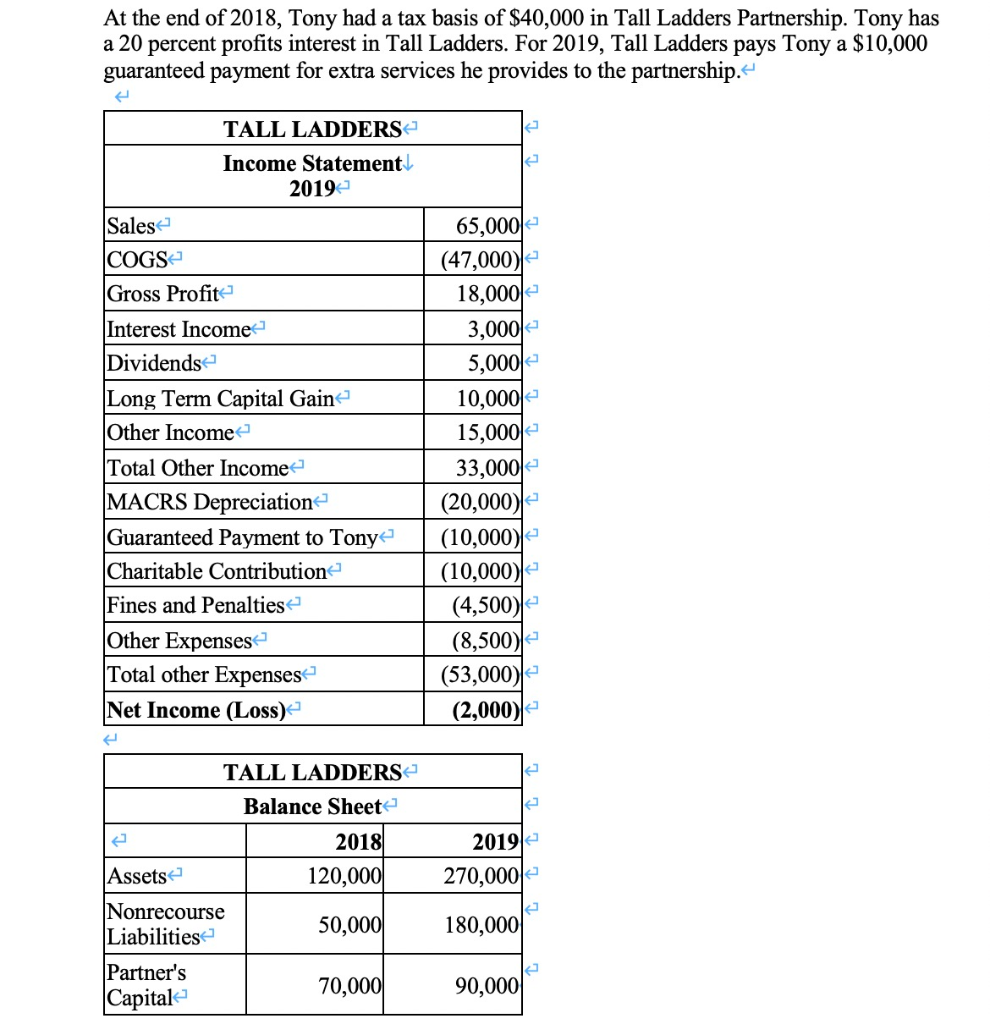

At the end of 2018, Tony had a tax basis of $40,000 in Tall Ladders Partnership. Tony has a 20 percent profits interest in Tall Ladders. For 2019, Tall Ladders pays Tony a $10,000 guaranteed payment for extra services he provides to the partnership. TALL LADDERS Income Statement 2019 Sales COGS Gross Profit Interest Income Dividends Long Term Capital Gain Other Income Total Other Income MACRS Depreciation Guaranteed Payment to Tony Charitable Contribution Fines and Penalties Other Expenses Total other Expenses Net Income (Loss) 65,000 (47,000) 18,000 3,000 5,000 10,000 15,000 33,000 (20,000) (10,000) (10,000) (4,500) (8,500) (53,000) (2,000) la TALL LADDERS Balance Sheet 2018 120,000 2019 270,000 50,000 180,000 Assets Nonrecourse Liabilities Partner's Capital 70,000 90,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts