Question: question working papers Answer this with all information needed Activity Two: Adjustments and the Worksheet The owner of Tuckamore Interiors, Ruby Tuckamore, in St. John's

question

working papers

Answer this with all information needed

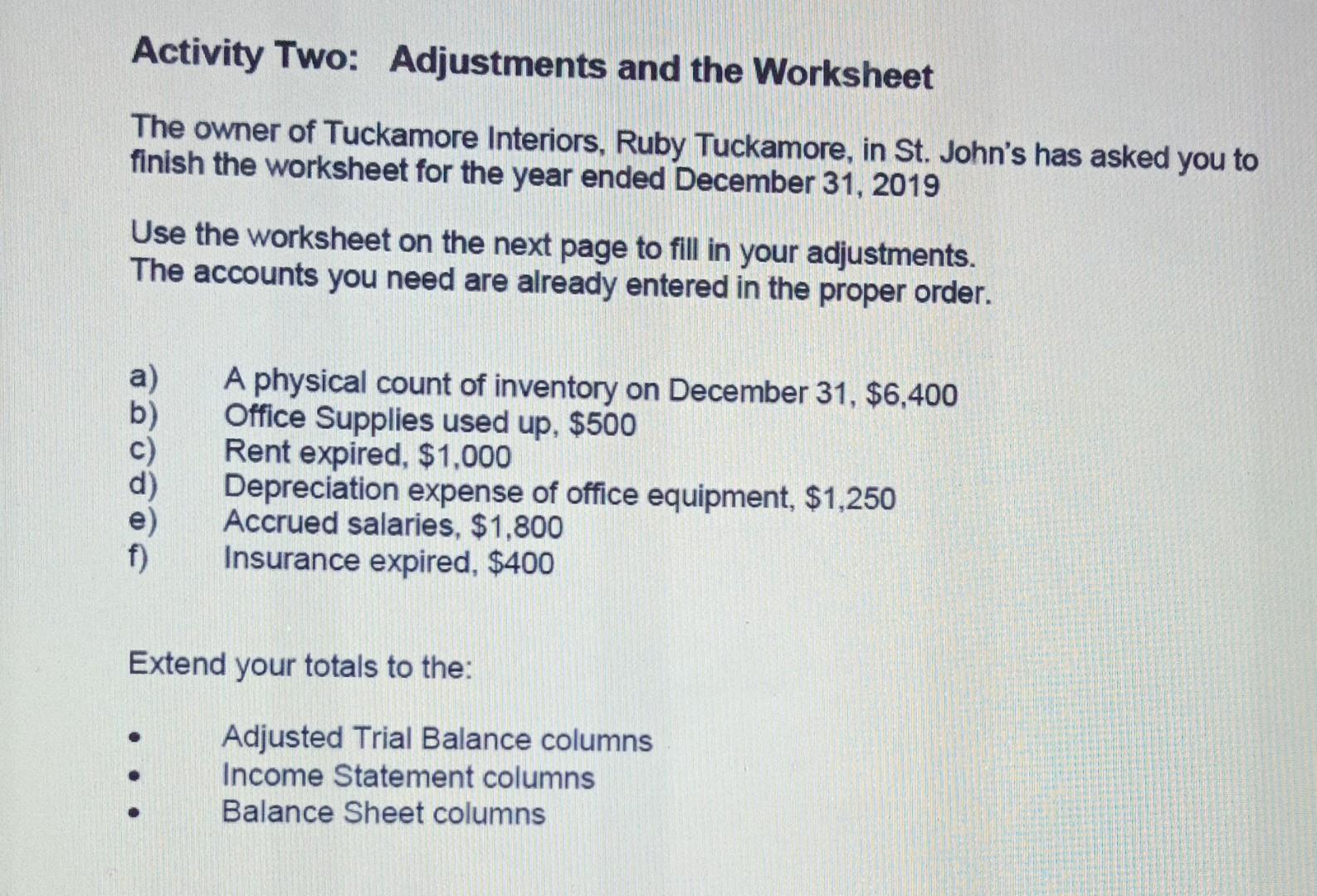

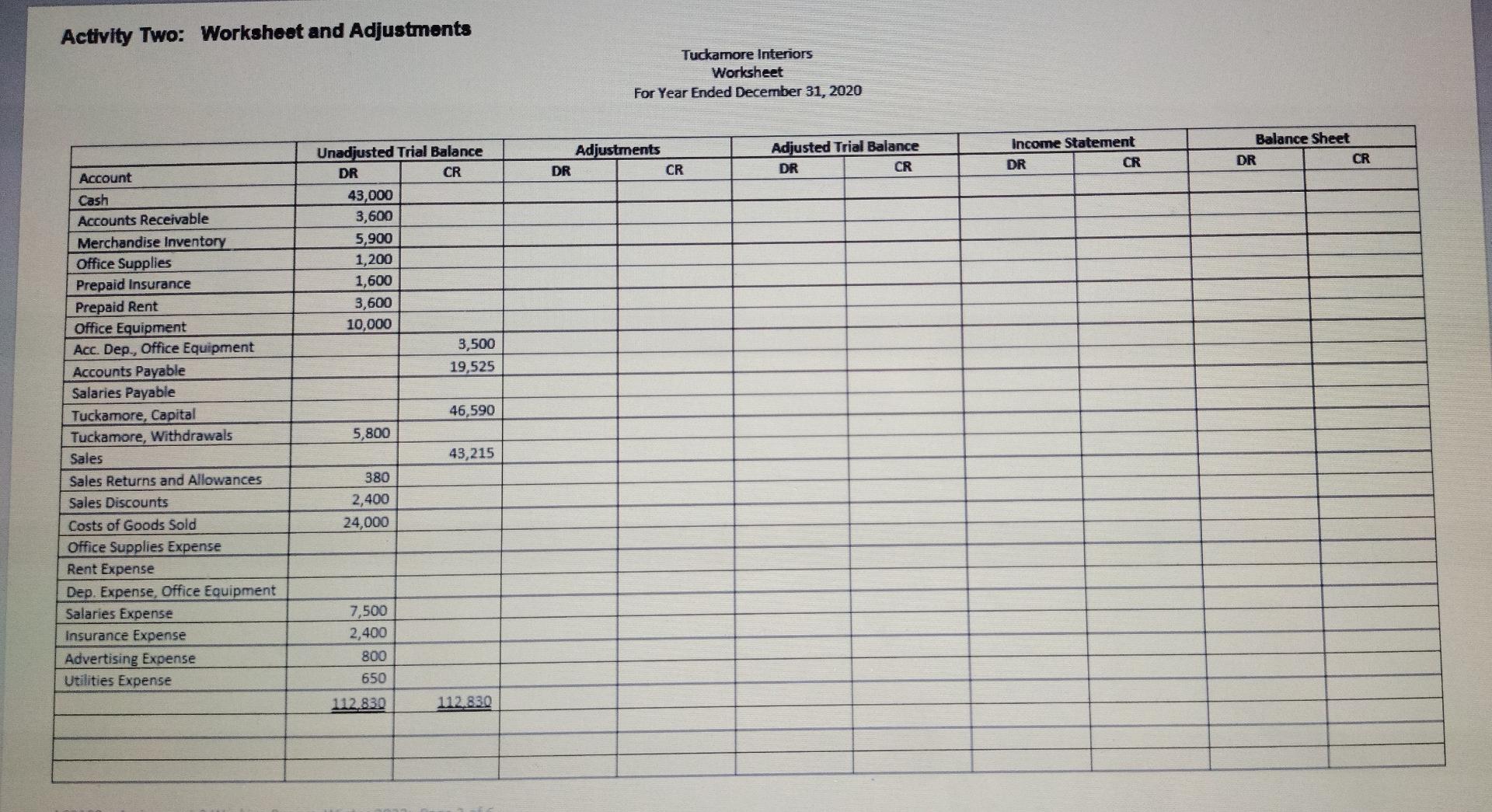

Activity Two: Adjustments and the Worksheet The owner of Tuckamore Interiors, Ruby Tuckamore, in St. John's has asked you to finish the worksheet for the year ended December 31, 2019 Use the worksheet on the next page to fill in your adjustments. The accounts you need are already entered in the proper order. a) b) A physical count of inventory on December 31, $6,400 Office Supplies used up, $500 Rent expired, $1,000 Depreciation expense of office equipment, $1,250 Accrued salaries, $1,800 Insurance expired, $400 f) Extend your totals to the: Adjusted Trial Balance columns Income Statement columns Balance Sheet columns Activity Two: Worksheet and Adjustments Tuckamore Interiors Worksheet For Year Ended December 31, 2020 Unadjusted Trial Balance DR CR Adjustments DR CR Adjusted Trial Balance DR CR Income Statement DR CR Balance Sheet DR CR 43,000 3,600 5,900 1,200 1,600 3,600 10,000 3,500 19,525 46,590 Account Cash Accounts Receivable Merchandise Inventory Office Supplies Prepaid Insurance Prepaid Rent Office Equipment Acc. Dep., Office Equipment Accounts Payable Salaries Payable Tuckamore, Capital Tuckamore, Withdrawals Sales Sales Returns and Allowances Sales Discounts Costs of Goods Sold Office Supplies Expense Rent Expense Dep. Expense, Office Equipment Salaries Expense insurance Expense Advertising Expense Utilities Expense 5,800 43,215 380 2,400 24,000 7,500 2,400 800 650 112.830 112.830 Joumalize your adlusling enteles to the General Journal provided. No Posting is required Page 23 General lounal Account Titles and Explanation Date PR Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts