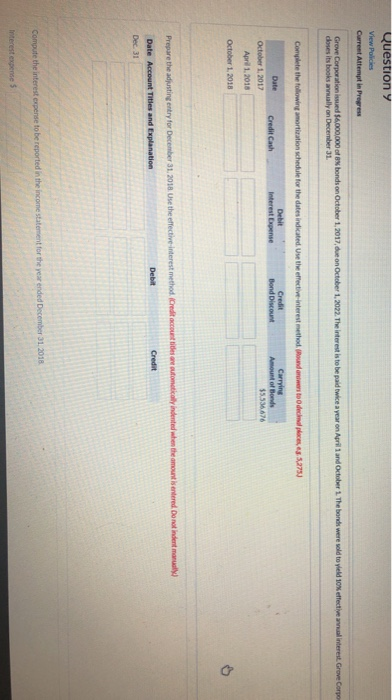

Question: Question y View Policies Current Attempt in Progress interest. Grove Corpo Grove Corporation issued $4,000,000 of x bondson October 1, 2017, due on October 1,2022.

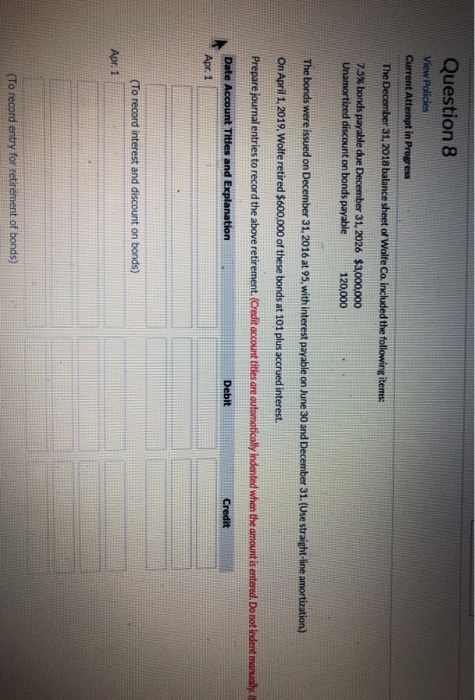

Question y View Policies Current Attempt in Progress interest. Grove Corpo Grove Corporation issued $4,000,000 of x bondson October 1, 2017, due on October 1,2022. The interest is to be paid twice a year on April 1 and October 1. The band were sold to yield 10% effective doses its books annually on December 31 Complete the following amortization schedule for the dates indicated. Use the effective interest methodundan to decid es 52753 Date Credit Cash Debit nterest Expense Credit Bond Discount Carrying Amount of Bonds $5.536.676 October 1, 2017 Apr 1. 2018 October 1, 2018 Sentered. Do not inden manual Prepare the adjusting entry for December 31, 2018 Use the effective interest method Credit account bien utom ly inderted Date Account Titles and Explanation Debit Credit Dec. 31 Compute the interest expense to be reported in the income statement for the year ended December 31, 2018 Interest expense Question 8 View Policies Current Attempt in Progress The December 31, 2018 balance sheet of Wolfe Co. included the following items: 7.5% bonds payable due December 31, 2026 $3,000,000 Unamortized discount on bonds payable 120,000 The bonds were issued on December 31, 2016 at 95, with interest payable on June 30 and December 31. (Use straight-line amortization) On April 1, 2019, Wolfe retired $600,000 of these bonds at 101 plus accrued interest. Prepare journal entries to record the above retirement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually Date Account Titles and Explanation Debit Credit Apr. 1 (To record interest and discount on bonds) Apr. 1 (To record entry for retirement of bonds)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts