Question: Question Year 0 1 2 3 Free Cash Flows ($ millions) ($200) $100 $80 $60 The market value balance sheet and information regarding Mercurtainment's cost

Question

Question

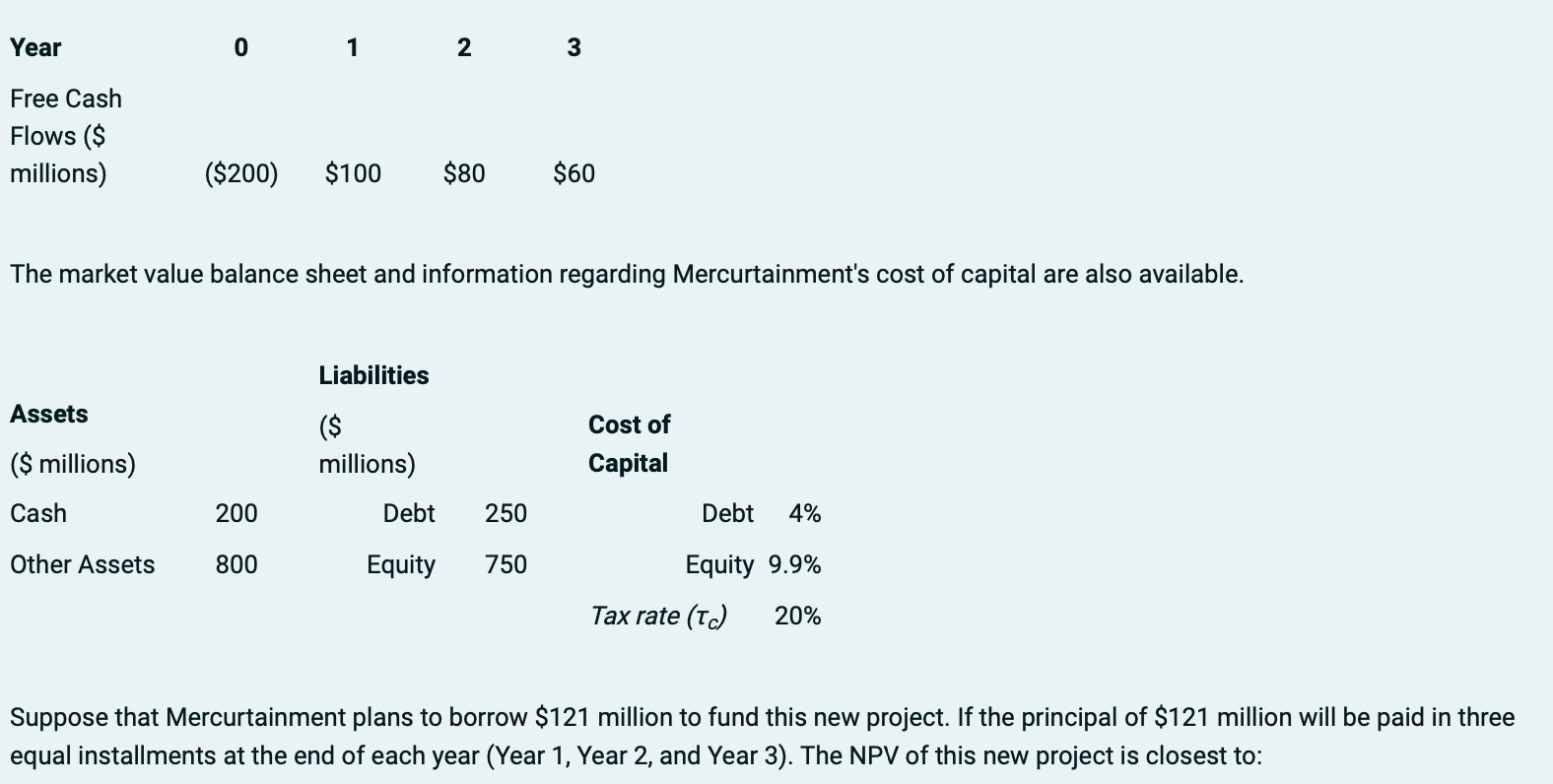

Year 0 1 2 3 Free Cash Flows ($ millions) ($200) $100 $80 $60 The market value balance sheet and information regarding Mercurtainment's cost of capital are also available. Liabilities Assets Cost of ($ millions) ($ millions) Capital Cash 200 Debt 250 Debt 4% Other Assets 800 Equity 750 Equity 9.9% Tax rate (T) 20% Suppose that Mercurtainment plans to borrow $121 million to fund this new project. If the principal of $121 million will be paid in three equal installments at the end of each year (Year 1, Year 2, and Year 3). The NPV of this new project is closest to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock