Question: Question-1 (21 pts 6+6+9 ) A 9-months forward contract on a stock is entered into when the stock price is $50 and the risk-free rate

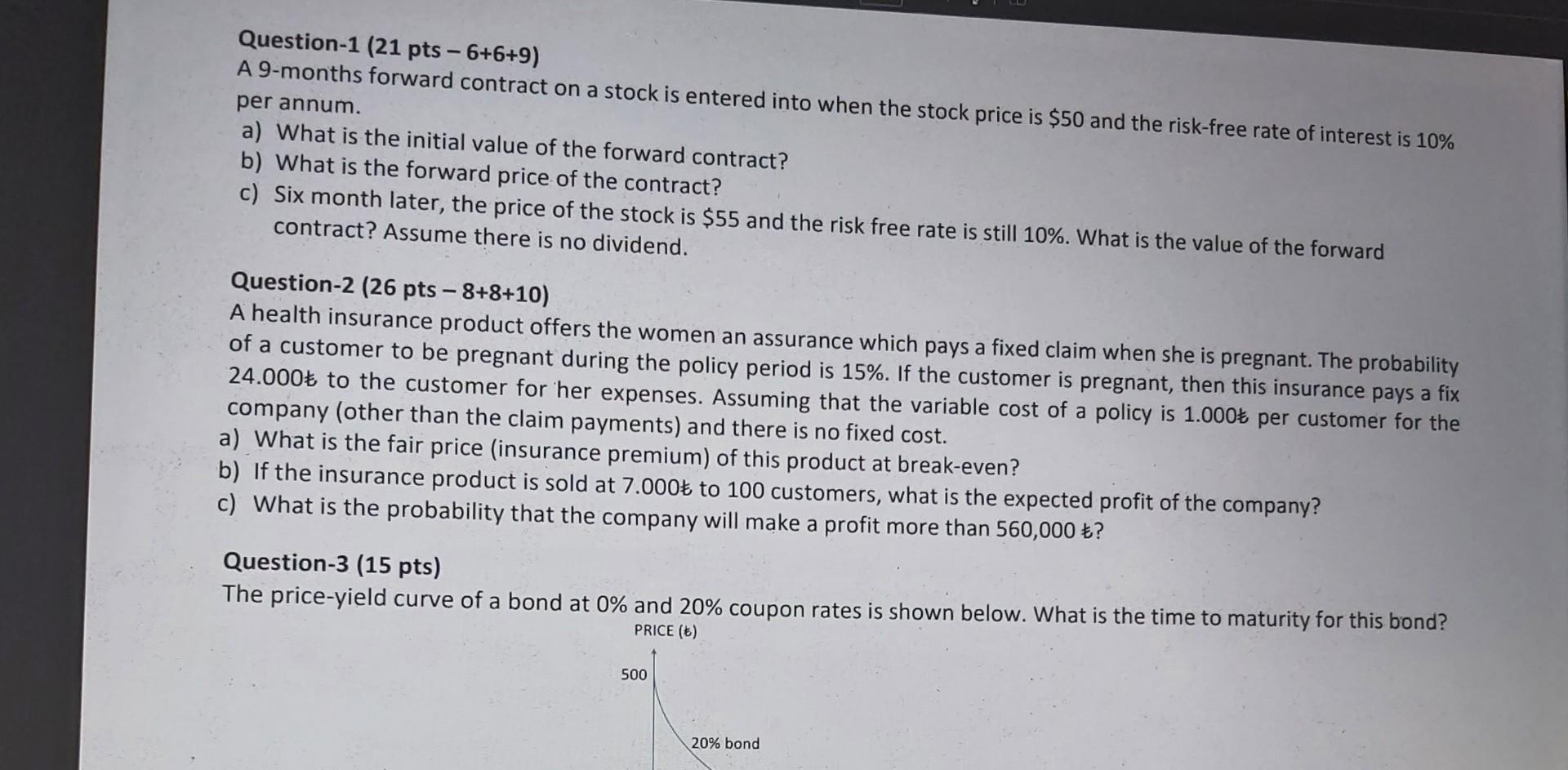

Question-1 (21 pts 6+6+9 ) A 9-months forward contract on a stock is entered into when the stock price is $50 and the risk-free rate of interest is 10% per annum. a) What is the initial value of the forward contract? b) What is the forward price of the contract? c) Six month later, the price of the stock is $55 and the risk free rate is still 10%. What is the value of the forward contract? Assume there is no dividend. Question-2 (26 pts 8+8+10) A health insurance product offers the women an assurance which pays a fixed claim when she is pregnant. The probability of a customer to be pregnant during the policy period is 15%. If the customer is pregnant, then this insurance pays a fix 24.000 to the customer for her expenses. Assuming that the variable cost of a policy is 1.000 t per customer for the company (other than the claim payments) and there is no fixed cost. a) What is the fair price (insurance premium) of thispodut at break-even? a) What is the fair price (insurance premium) of this product at break-even? b) If the insurance product is sold at 7.000 t to 100 customers, what is the expected profit of the company? c) What is the probability that the company will make a profit more than 560,000 ? Question-3 (15 pts) The price-yield curve of a bond at 0% and 20% coupon rates is shown below. What is the time to maturity for this bond? PRICE (E) Question-1 (21 pts 6+6+9 ) A 9-months forward contract on a stock is entered into when the stock price is $50 and the risk-free rate of interest is 10% per annum. a) What is the initial value of the forward contract? b) What is the forward price of the contract? c) Six month later, the price of the stock is $55 and the risk free rate is still 10%. What is the value of the forward contract? Assume there is no dividend. Question-2 (26 pts 8+8+10) A health insurance product offers the women an assurance which pays a fixed claim when she is pregnant. The probability of a customer to be pregnant during the policy period is 15%. If the customer is pregnant, then this insurance pays a fix 24.000 to the customer for her expenses. Assuming that the variable cost of a policy is 1.000 t per customer for the company (other than the claim payments) and there is no fixed cost. a) What is the fair price (insurance premium) of thispodut at break-even? a) What is the fair price (insurance premium) of this product at break-even? b) If the insurance product is sold at 7.000 t to 100 customers, what is the expected profit of the company? c) What is the probability that the company will make a profit more than 560,000 ? Question-3 (15 pts) The price-yield curve of a bond at 0% and 20% coupon rates is shown below. What is the time to maturity for this bond? PRICE (E)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts