Question: Question#1. I would like to get an answer using the given table! Thanks a lot:D Example #1: You are looking to invest in a new

Question#1.

I would like to get an answer using the given table! Thanks a lot:D

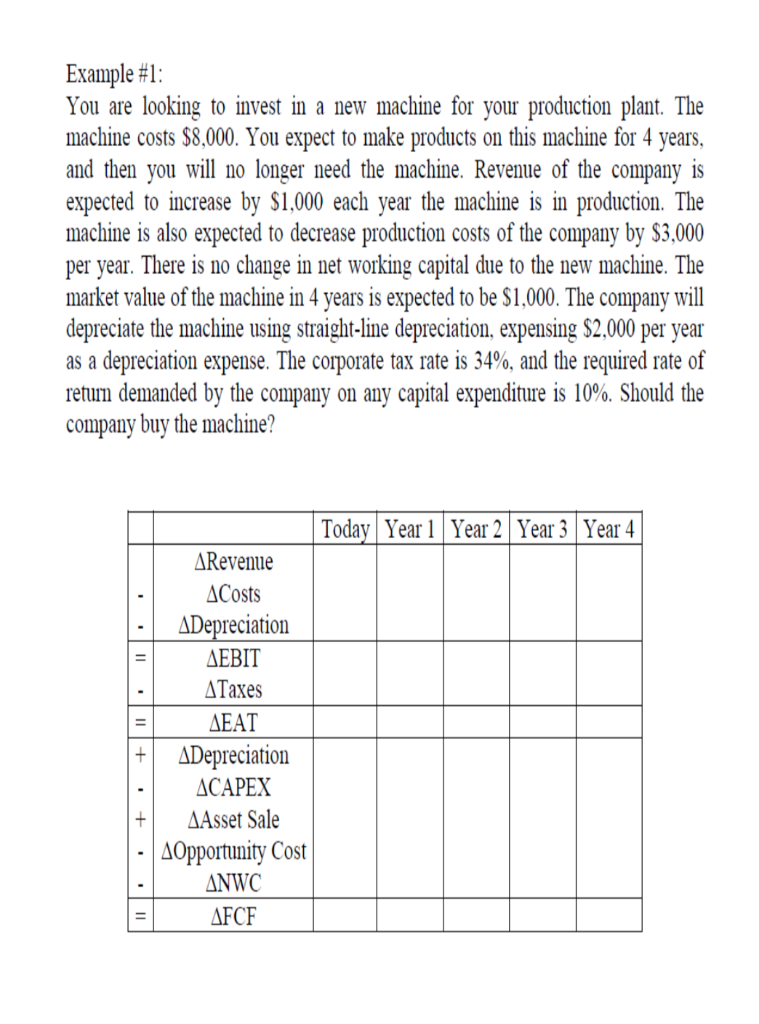

Example #1: You are looking to invest in a new machine for your production plant. The machine costs $8,000. You expect to make products on this machine for 4 years, and then you will no longer need the machine. Revenue of the company is expected to increase by $1,000 each year the machine is in production. The machine is also expected to decrease production costs of the company by $3,000 per year. There is no change in net working capital due to the new machine. The market value of the machine in 4 years is expected to be $1,000. The company will depreciate the machine using straight-line depreciation, expensing $2,000 per year as a depreciation expense. The corporate tax rate is 34%, and the required rate of retuin demanded by the company on any capital expenditure is 10%. Should the company buy the machine? Today Year 1 Year 2 Year 3 Year 4 ARevenue ACosts ADepreciation AEBIT ATaxes AEAT ADepreciation ACAPEX AAsset Sale AOpportunity Cost ANWC AFCF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts