Question: Question1: Let's focus now on the problem of a single agent our OLG economy. As usual, she receives an endowment y = 100 when young

Question1:

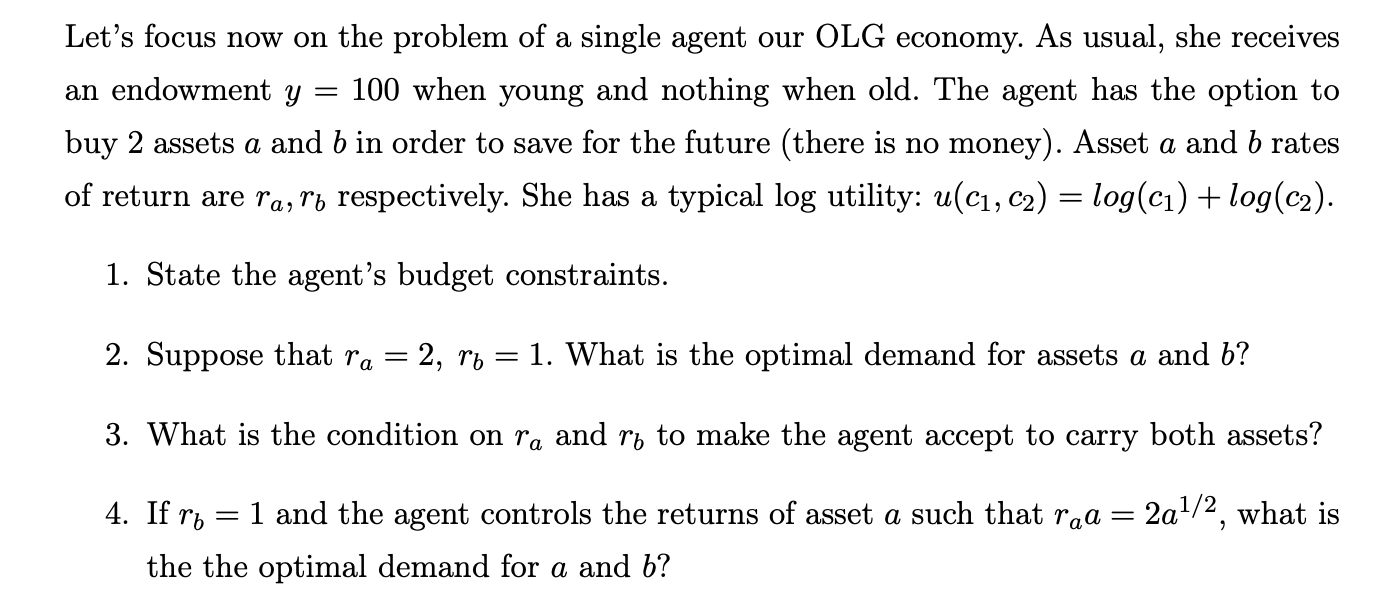

Let's focus now on the problem of a single agent our OLG economy. As usual, she receives an endowment y = 100 when young and nothing when old. The agent has the option to buy 2 assets (1 and bin order to save for the future (there is no money). Asset a and b rates of return are Ta, r1, respectively. She has a typical log utility: u(c1, C2) = log(c1) + log(cz). 1. State the agent's budget constraints. 2. Suppose that Ta = 2, r1, = 1. What is the optimal demand for assets (1 and b? 3. What is the condition on rm and n, to make the agent accept to carry both assets? 1/2 4. If n, = 1 and the agent controls the returns of asset a such that Tat], = 2a , What is the the optimal demand for a. and b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts