Question: question:1 make an income statement question 2: make cash flow 1. (20 points) You and a classmate are considering going into business as one of

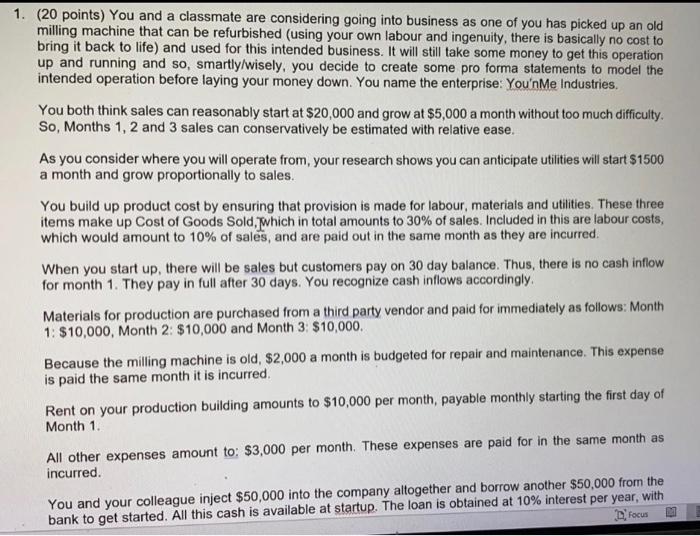

1. (20 points) You and a classmate are considering going into business as one of you has picked up an old milling machine that can be refurbished (using your own labour and ingenuity, there is basically no cost to bring it back to life) and used for this intended business. It will still take some money to get this operation up and running and so, smartly/wisely, you decide to create some pro forma statements to model the intended operation before laying your money down. You name the enterprise: You'n Me Industries. You both think sales can reasonably start at $20,000 and grow at $5,000 a month without too much difficulty. So, Months 1, 2 and 3 sales can conservatively be estimated with relative ease. As you consider where you will operate from your research shows you can anticipate utilities will start $1500 a month and grow proportionally to sales. You build up product cost by ensuring that provision is made for labour, materials and utilities. These three items make up Cost of Goods Sold, which in total amounts to 30% of sales. Included in this are labour costs, which would amount to 10% of sales, and are paid out in the same month as they are incurred When you start up, there will be sales but customers pay on 30 day balance. Thus, there is no cash inflow for month 1. They pay in full after 30 days. You recognize cash inflows accordingly. Materials for production are purchased from a third party vendor and paid for immediately as follows: Month 1: $10,000, Month 2: $10,000 and Month 3: $10,000. Because the milling machine is old, $2,000 a month is budgeted for repair and maintenance. This expense is paid the same month it is incurred. Rent on your production building amounts to $10,000 per month, payable monthly starting the first day of Month 1. All other expenses amount to: $3,000 per month. These expenses are paid for in the same month as incurred. You and your colleague inject $50,000 into the company altogether and borrow another $50,000 from the bank to get started. All this cash is available at startup. The loan is obtained at 10% interest per year, with Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts