Question: Question1 Question 2 ( Please help Me Thanks ) Total debt Total capital Total debt Total debt + Equity The High debt ratios that exceed

Question1

Question 2 ( Please help Me Thanks )

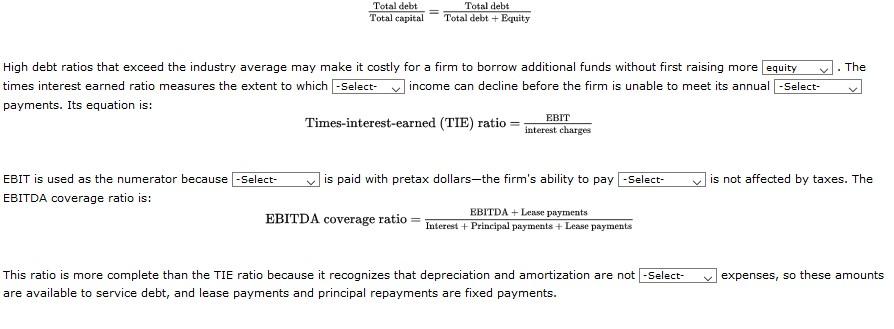

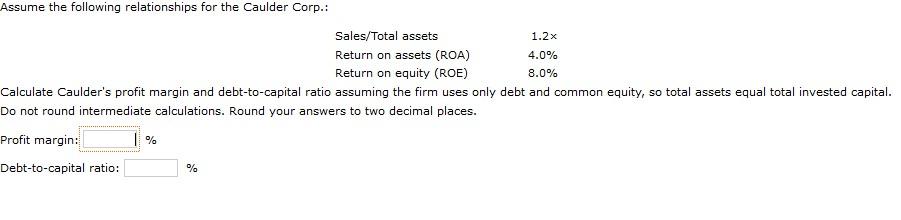

Total debt Total capital Total debt Total debt + Equity The High debt ratios that exceed the industry average may make it costly for a firm to borrow additional funds without first raising more equity times interest earned ratio measures the extent to which -Select- Vincome can decline before the firm is unable to meet its annual -Select- payments. Its equation is: EBIT Times-interest-earned (TIE) ratio = interest charges is not affected by taxes. The EBIT is used as the numerator because -Select- is paid with pretax dollarsthe firm's ability to pay -Select- EBITDA coverage ratio is: EBITDA + Lense payments EBITDA coverage ratio Interest + Principal payments + Lease payments expenses, so these amounts This ratio is more complete than the TIE ratio because it recognizes that depreciation and amortization are not -Select- are available to service debt, and lease payments and principal repayments are fixed payments. Assume the following relationships for the Caulder Corp.: Sales/Total assets 1.2x Return on assets (ROA) 4.0% Return on equity (ROE) 8.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: Debt-to-capital ratio: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts