Question: question1 question2 question3 question4 question5 question6 question7 I only want the answer, thanks! I could find the processes by myself. Carla Vista Company is evaluating

question1

question2

question3

question3

question4

question4

question5

question5

question6

question6

question7

question7

I only want the answer, thanks! I could find the processes by myself.

I only want the answer, thanks! I could find the processes by myself.

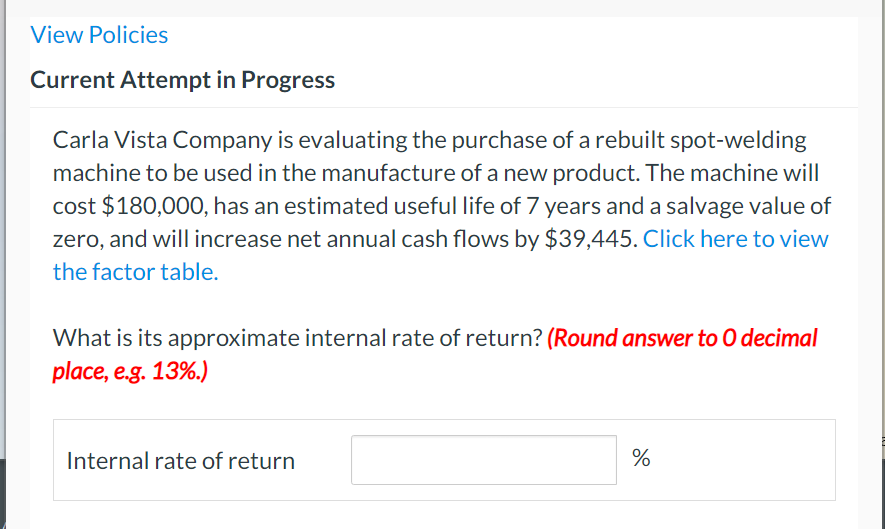

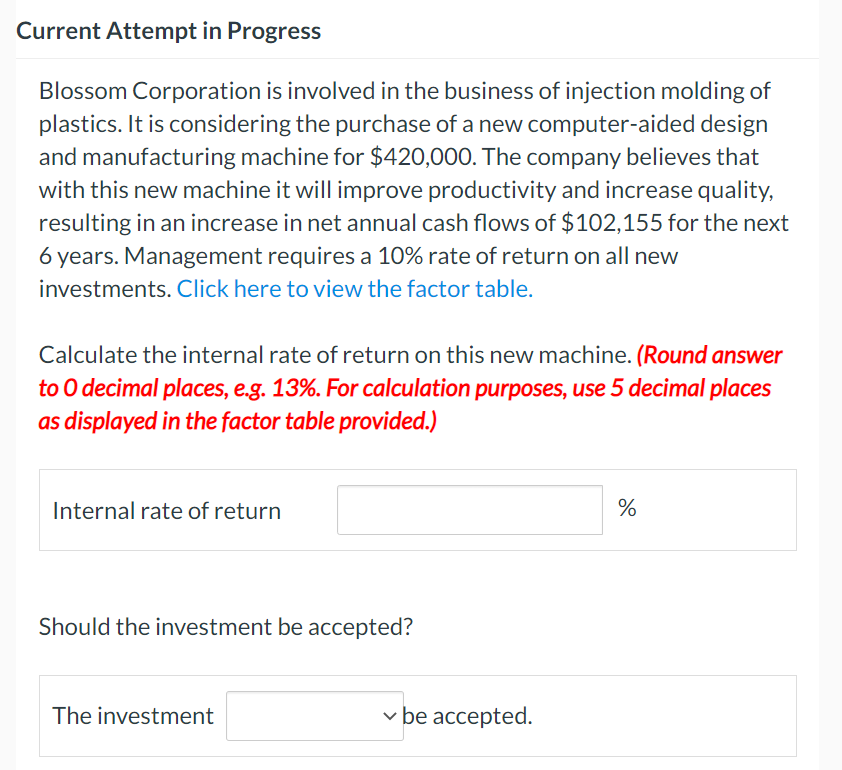

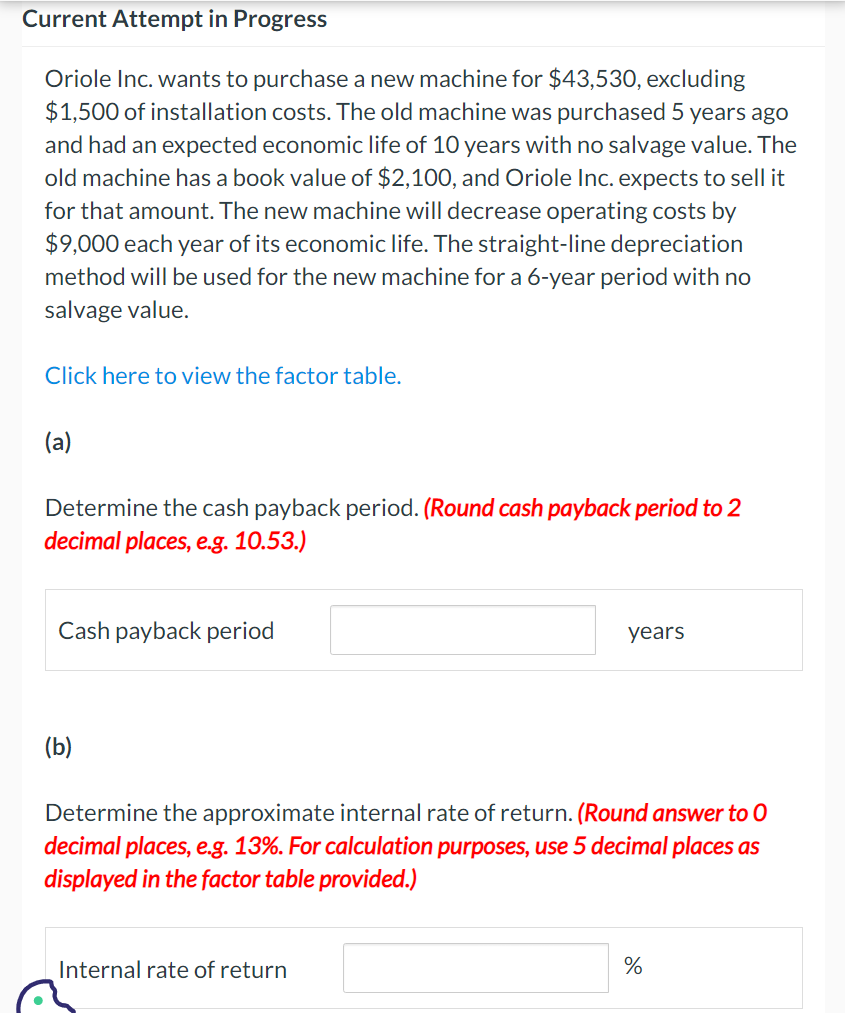

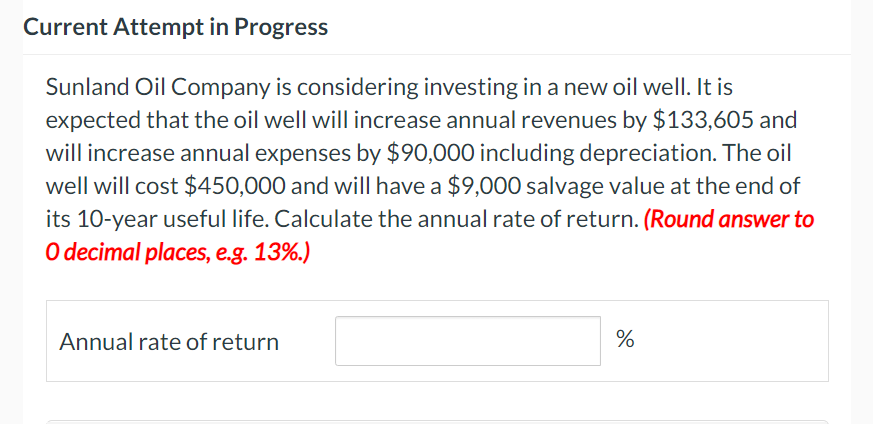

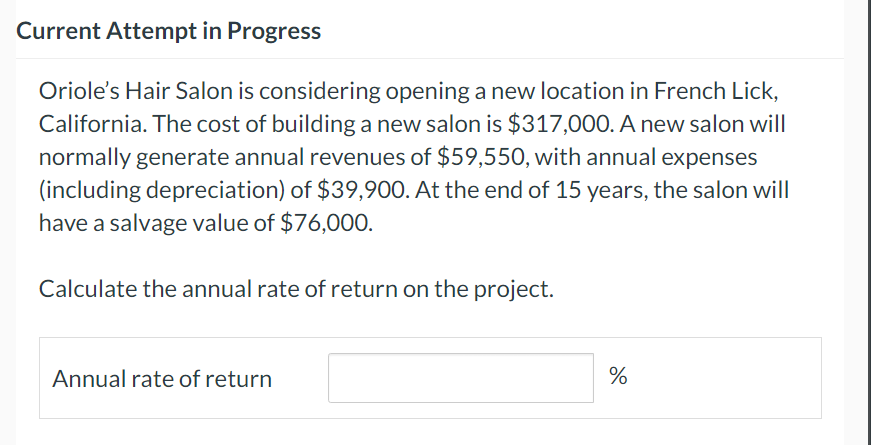

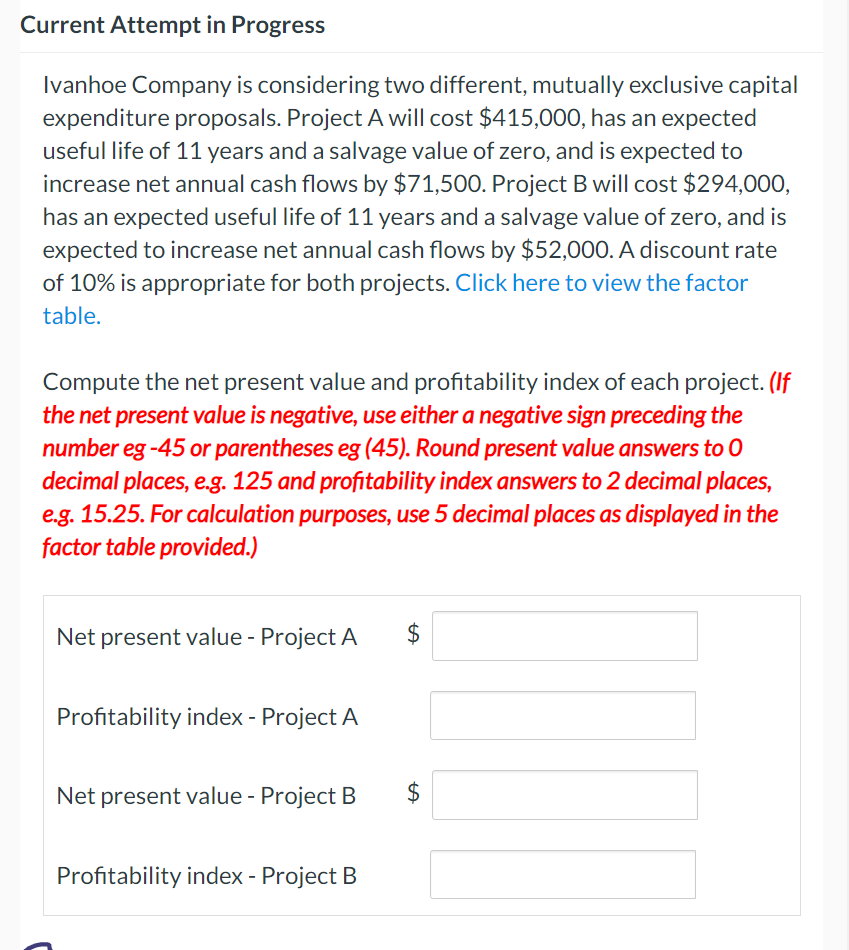

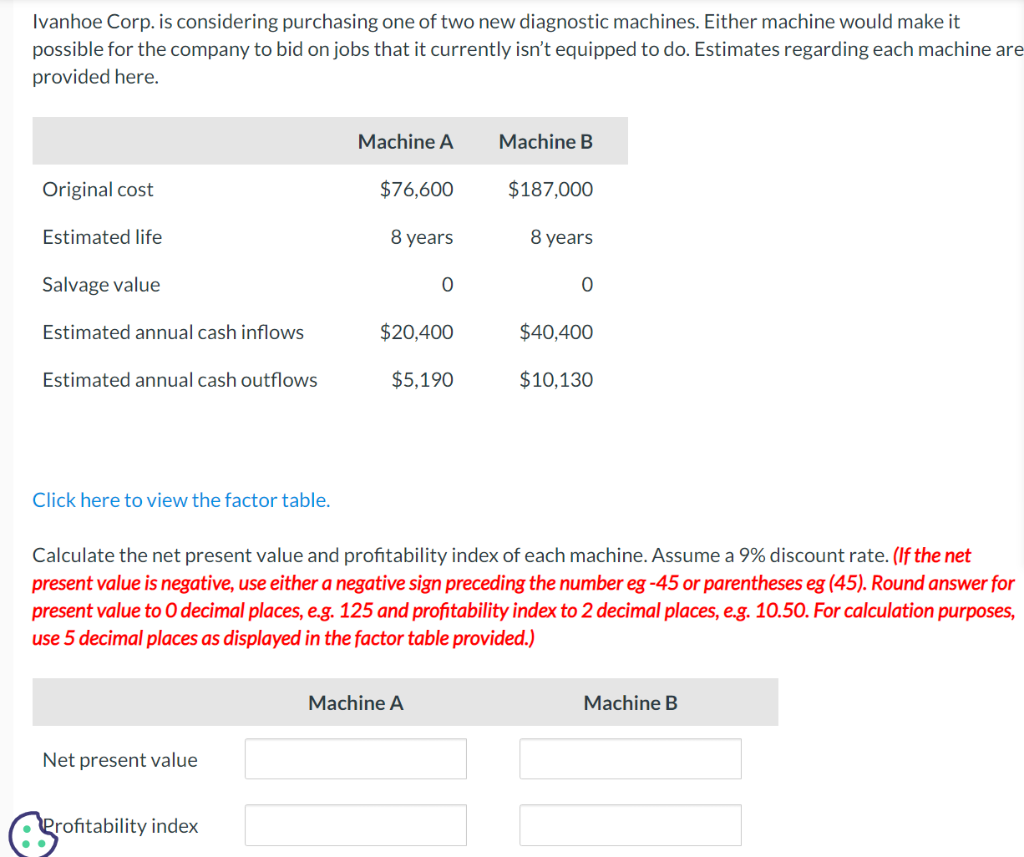

Carla Vista Company is evaluating the purchase of a rebuilt spot-welding machine to be used in the manufacture of a new product. The machine will cost $180,000, has an estimated useful life of 7 years and a salvage value of zero, and will increase net annual cash flows by $39,445. Click here to view the factor table. What is its approximate internal rate of return? (Round answer to 0 decimal place, e.g. 13\%.) Blossom Corporation is involved in the business of injection molding of plastics. It is considering the purchase of a new computer-aided design and manufacturing machine for $420,000. The company believes that with this new machine it will improve productivity and increase quality, resulting in an increase in net annual cash flows of $102,155 for the next 6 years. Management requires a 10% rate of return on all new investments. Click here to view the factor table. Calculate the internal rate of return on this new machine. (Round answer to 0 decimal places, e.g. 13\%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Internal rate of return % Should the investment be accepted? Oriole Inc. wants to purchase a new machine for $43,530, excluding $1,500 of installation costs. The old machine was purchased 5 years ago and had an expected economic life of 10 years with no salvage value. The old machine has a book value of $2,100, and Oriole Inc. expects to sell it for that amount. The new machine will decrease operating costs by \$9,000 each year of its economic life. The straight-line depreciation method will be used for the new machine for a 6-year period with no salvage value. Click here to view the factor table. (a) Determine the cash payback period. (Round cash payback period to 2 decimal places, e.g. 10.53.) Cash payback period years (b) Determine the approximate internal rate of return. (Round answer to 0 decimal places, e.g. 13\%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Sunland Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $133,605 and will increase annual expenses by $90,000 including depreciation. The oil well will cost $450,000 and will have a $9,000 salvage value at the end of its 10-year useful life. Calculate the annual rate of return. (Round answer to O decimal places, e.g. 13\%.) Oriole's Hair Salon is considering opening a new location in French Lick, California. The cost of building a new salon is $317,000. A new salon will normally generate annual revenues of $59,550, with annual expenses (including depreciation) of $39,900. At the end of 15 years, the salon will have a salvage value of $76,000. Calculate the annual rate of return on the project. has an expected useful life of 11 years and a salvage value of zero, and is expected to increase net annual cash flows by $52,000. A discount rate of 10% is appropriate for both projects. Click here to view the factor table. Compute the net present value and profitability index of each project. (If the net present value is negative, use either a negative sign preceding the number eg 45 or parentheses eg (45). Round present value answers to 0 decimal places, e.g. 125 and profitability index answers to 2 decimal places, e.g. 15.25. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value - Project A $ Profitability index - Project A Net present value - Project B $ Profitability index - Project B Ivanhoe Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here. Click here to view the factor table. Calculate the net present value and profitability index of each machine. Assume a 9\% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round answer for present value to 0 decimal places, e.g. 125 and profitability index to 2 decimal places, e.g. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts