Question: Question2 (3+4) a. A bond with 5 years to maturity and coupon payment is 9 percent, market price is Tk. 1025, and par value is

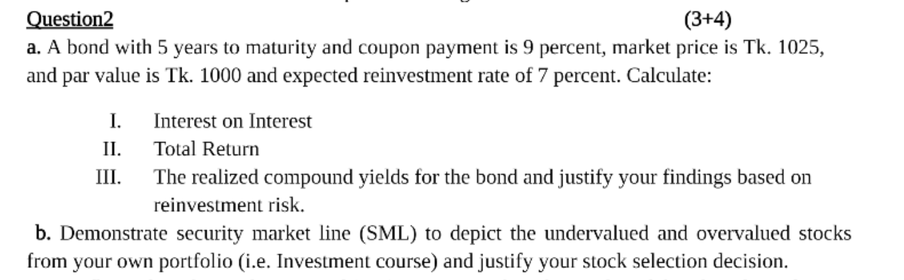

Question2 (3+4) a. A bond with 5 years to maturity and coupon payment is 9 percent, market price is Tk. 1025, and par value is Tk. 1000 and expected reinvestment rate of 7 percent. Calculate: I. Interest on Interest II. Total Return III. The realized compound yields for the bond and justify your findings based on reinvestment risk. b. Demonstrate security market line (SML) to depict the undervalued and overvalued stocks from your own portfolio (i.e. Investment course) and justify your stock selection decision. Question2 (3+4) a. A bond with 5 years to maturity and coupon payment is 9 percent, market price is Tk. 1025, and par value is Tk. 1000 and expected reinvestment rate of 7 percent. Calculate: I. Interest on Interest II. Total Return III. The realized compound yields for the bond and justify your findings based on reinvestment risk. b. Demonstrate security market line (SML) to depict the undervalued and overvalued stocks from your own portfolio (i.e. Investment course) and justify your stock selection decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts