Question: Question2 A. The class will be divided into groups of about 4-6 students. Each group will be responsible for funding a pension plan with required

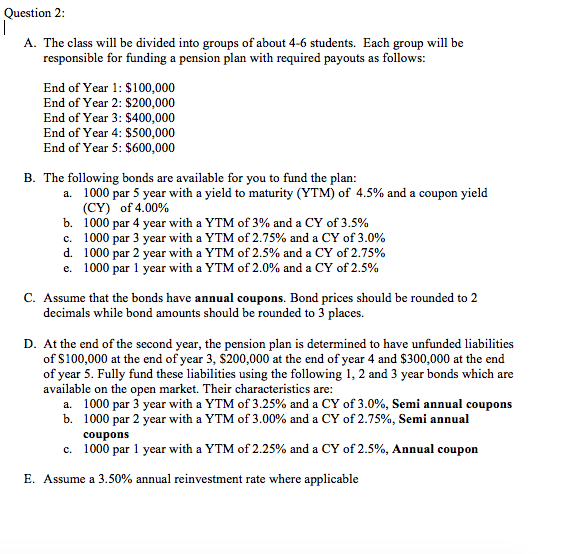

Question2 A. The class will be divided into groups of about 4-6 students. Each group will be responsible for funding a pension plan with required payouts as follows: End of Year 1: $100,000 End of Year 2: $200,000 End of Year 3: $400,000 End of Year 4: $500,000 End of Year 5: $600,000 B. The following bonds are available for you to fund the plan: 1000 par 5 year with a yield to maturity (YTM) of 4.5% and a coupon yield (CY') of 4.00% 1000 par 4 year with a YTM of 3% and a CY of 3.5% 1000 par 3 year with a YTM of 2.75% and a CY of 3.0% 1000 par 2 year with a YTM of 2.5% and a CY of 2.75% 1000 par 1 year with a YTM of 2.0% and a CY of 2.5% a. b. c, d, e, C. Assume that the bonds have annual coupons. Bond prices should be rounded to 2 decimals while bond amounts should be rounded to 3 places. D. At the end of the second year, the pension plan is determined to have unfunded liabilities of S100,000 at the end of year 3, S200,000 at the end of year 4 and $300,000 at the end of year 5. Fully fund these liabilities using the following 1, 2 and 3 year bonds which are available on the open market. Their characteristics are: a. 1000 par 3 year with a YTM of 3.25% and a CY of 3.0%, Semi annual coupons b. 1000 par 2 year with a YTM of 3.00% and a CY of 2.75%, Semi annual coupons c. 1000 par 1 year with a YTM of 2.25% and a CY of 2.5%, Annual coupon E. Assume a 3.50% annual reinvestment rate where applicable Question2 A. The class will be divided into groups of about 4-6 students. Each group will be responsible for funding a pension plan with required payouts as follows: End of Year 1: $100,000 End of Year 2: $200,000 End of Year 3: $400,000 End of Year 4: $500,000 End of Year 5: $600,000 B. The following bonds are available for you to fund the plan: 1000 par 5 year with a yield to maturity (YTM) of 4.5% and a coupon yield (CY') of 4.00% 1000 par 4 year with a YTM of 3% and a CY of 3.5% 1000 par 3 year with a YTM of 2.75% and a CY of 3.0% 1000 par 2 year with a YTM of 2.5% and a CY of 2.75% 1000 par 1 year with a YTM of 2.0% and a CY of 2.5% a. b. c, d, e, C. Assume that the bonds have annual coupons. Bond prices should be rounded to 2 decimals while bond amounts should be rounded to 3 places. D. At the end of the second year, the pension plan is determined to have unfunded liabilities of S100,000 at the end of year 3, S200,000 at the end of year 4 and $300,000 at the end of year 5. Fully fund these liabilities using the following 1, 2 and 3 year bonds which are available on the open market. Their characteristics are: a. 1000 par 3 year with a YTM of 3.25% and a CY of 3.0%, Semi annual coupons b. 1000 par 2 year with a YTM of 3.00% and a CY of 2.75%, Semi annual coupons c. 1000 par 1 year with a YTM of 2.25% and a CY of 2.5%, Annual coupon E. Assume a 3.50% annual reinvestment rate where applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts