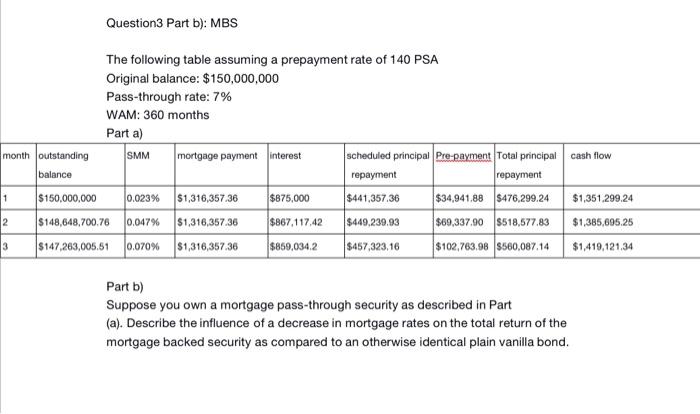

Question: Question3 Part b Question3 Part b): MBS The following table assuming a prepayment rate of 140 PSA Original balance: $150,000,000 Pass-through rate: 7% WAM: 360

Question3 Part b): MBS The following table assuming a prepayment rate of 140 PSA Original balance: $150,000,000 Pass-through rate: 7% WAM: 360 months Parta) month outstanding SMM mortgage payment interest scheduled principal Pre-payment Total principal cash flow balance repayment repayment $150,000,000 0.023% $1,316,357.36 $875,000 $441,357.36 $34,941.88 $476.299.24 $1,351.299.24 2 S148,648,700.76 0.0479 $1,316,357.36 $867,117,42 $449,239.93 $69,337.90 $518,577.83 $1,385,695.25 3 $147,263,005.51 0.070% 51,316,357.36 $860,034.2 $457,323,16 $102,763,98 $580.087.14 $1,419.121.34 1 Part b) Suppose you own a mortgage pass-through security as described in Part (a). Describe the influence of a decrease in mortgage rates on the total return of the mortgage backed security as compared to an otherwise identical plain vanilla bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts