Question: Question4 (b) Identify the highest lease payment Lmax that 975 Supermarket is willing to pay. (4 marks) (c) Identify the lowest lease payment income Lmin

Question4

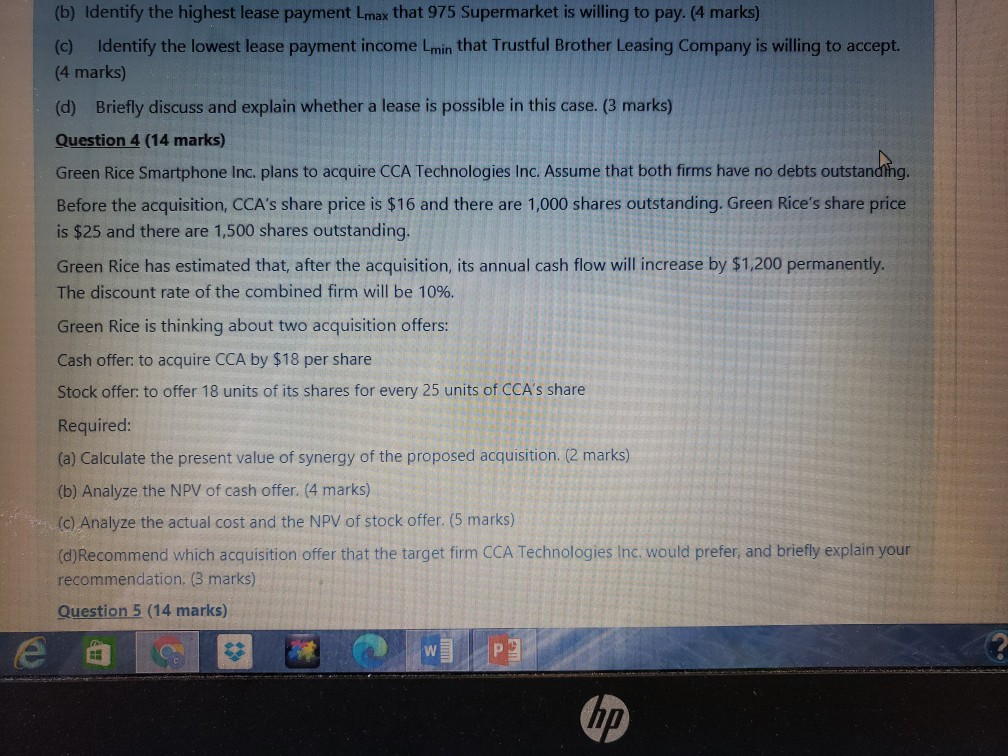

(b) Identify the highest lease payment Lmax that 975 Supermarket is willing to pay. (4 marks) (c) Identify the lowest lease payment income Lmin that Trustful Brother Leasing Company is willing to accept. (4 marks) (d) Briefly discuss and explain whether a lease is possible in this case. (3 marks) Question 4 (14 marks) Green Rice Smartphone Inc. plans to acquire CCA Technologies Inc. Assume that both firms have no debts outstanding. Before the acquisition, CCA's share price is $16 and there are 1,000 shares outstanding. Green Rice's share price is $25 and there are 1,500 shares outstanding. Green Rice has estimated that, after the acquisition, its annual cash flow will increase by $1,200 permanently. The discount rate of the combined firm will be 10%. Green Rice is thinking about two acquisition offers: Cash offer to acquire CCA by $18 per share Stock offer to offer 18 units of its shares for every 25 units of CCA's share Required: (a) Calculate the present value of synergy of the proposed acquisition. (2 marks) (b) Analyze the NPV of cash offer. (4 marks) (c) Analyze the actual cost and the NPV of stock offer. (5 marks) (d) Recommend which acquisition offer that the target firm CCA Technologies Inc. would prefer, and briefly explain your recommendation. (3 marks) Question 5 (14 marks) hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts