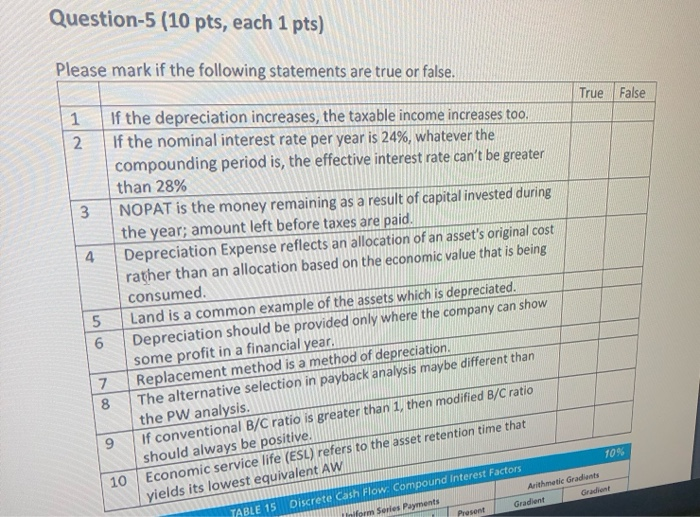

Question: Question-5 (10 pts, each 1 pts) Please mark if the following statements are true or false. True False 1 2 3 4 If the depreciation

Question-5 (10 pts, each 1 pts) Please mark if the following statements are true or false. True False 1 2 3 4 If the depreciation increases, the taxable income increases too, If the nominal interest rate per year is 24%, whatever the compounding period is, the effective interest rate can't be greater than 28% NOPAT is the money remaining as a result of capital invested during the year; amount left before taxes are paid. Depreciation Expense reflects an allocation of an asset's original cost rather than an allocation based on the economic value that is being consumed. Land is a common example of the assets which is depreciated. Depreciation should be provided only where the company can show some profit in a financial year. Replacement method is a method of depreciation. 5 6 7 8 9 The alternative selection in payback analysis maybe different than the PW analysis. If conventional B/C ratio is greater than 1, then modified B/C ratio should always be positive. Economic service life (ESL) refers to the asset retention time that yields its lowest equivalent AW TABLE 15 Discrete Cash Flow. Compound interest Factors Iniform Series Payments 10 10% Arithmetic Gradients Gradient Gradient Present

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts