Question: QuestionIf Gadget.com decides that there is no need to adopt the lowest cost option if there is strong justification for using another option, will you

QuestionIf Gadget.com decides that there is no need to adopt the lowest cost option if there is strong justification for using another option, will you change your recommendation? If yes, which option will you recommend and why? Support the argument with a good discussion using some relevant references.

Today 20:54

School RMIT Bachelor of Logistics and Supply Chain Management course omgt 2229 Supply Chain Strategic

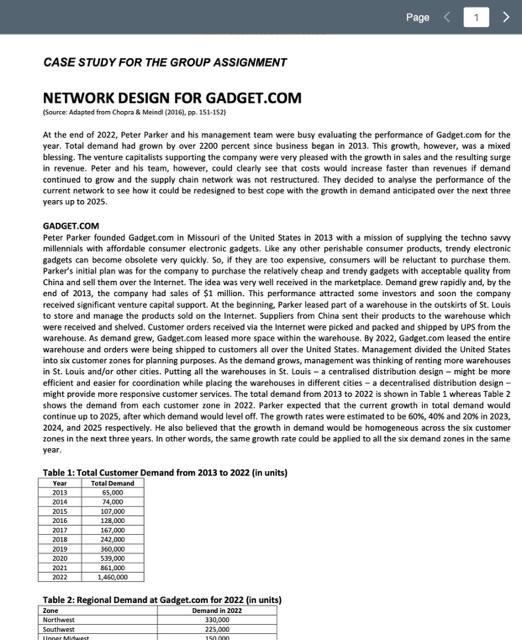

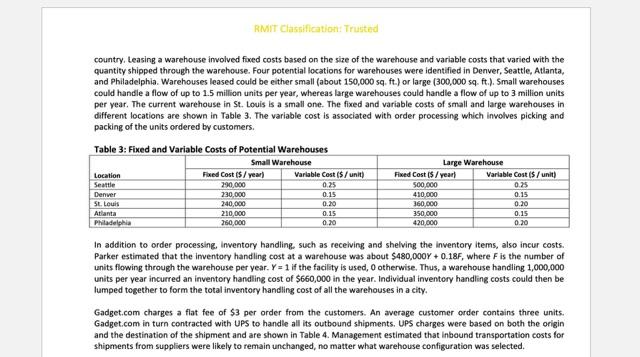

At the end of 2022, Peter Parker and his management team were busy evaluating the performance of Gadget.com for the year. Total demand had grown by over 2200 percent since business began in 2013 . This growth, however, was a mixed blessing. The venture capitalists supporting the company were very pleased with the growth in sales and the resulting surge in revenue. Peter and his team, however, could clearly see that costs would increase faster than revenues if demand continued to grow and the supply chain network was not restructured. They decided to analyse the performance of the current network to see how it could be redesigned to best cope with the growth in demand anticipated over the next three years up to 2025. GADGET.COM Peter Parker founded Gadget.com in Missouri of the United States in 2013 with a mission of supplying the techno savvy millennials with affordable consumer electronic gadgets. Like any other perishable consumer products, trendy electronic gadgets can become obsolete very quickly. So, if they are too expensive, consumers will be reluctant to purchase them. Parker's initial plan was for the company te purchase the relatively cheap and trendy gadgets with acceptable quality from China and seil them over the lnternet. The idea was very well received in the marketplace. Demand grew rapidly and, by the end of 2013, the company had sales of $1 million. This performance attracted some investors and soon the company received significant venture capital support. At the beginning. Parker leased part of a warehouse in the outskirts of 5t. Louis to store and manage the products sold on the Internet. Suppliers from China sent their products to the warehouse which were recelved and shelved. Customer orders received via the Internet were picked and packed and shipped by UPS from the warehouse. As demand grew, Gadget.com leased more space within the warehouse. By 2022, Gadget.com leased the entire warehouse and orders were being shipped to customers all over the United States. Management divided the United States into six customer zones for planning purposes. As the demand grows, management was thinking of renting more warehouses in St. Louis and/or other cities. Putting all the warehouses in St. Louis - a centralised distribution design - might be more efficient and easier for coordination while placing the warehouses in different cities - a decentralised distribution design might provide more responsive customer services. The total demand from 2013 to 2022 is shown in Table 1 whereas Table 2 shows the demand from each customer zone in 2022. Parker expected that the current growth in total demand would continue up to 2025, after which demand would level off. The growth rates were estimated to be 60%,40% and 20% in 2023 , 2024, and 2025 respectively. He alse believed that the grewth in demand would be homogeneous across the six customer zones in the next three years, In other words, the same growth rate could be applied to all the six demand zones in the same year. Table 1: Total Customer Demand from 2013 to 2022 (in units) Table 2: Reeional Demand at Gadeet.com for 2022 (in units) country, Leasing a warehouse involved fixed costs based on the size of the warehouse and variable costs that varied with the quantity shipped through the warehouse. Four potential locations for warehouses were identified in Denver, Seattle, Atlanta, and Philadelphia. Warehouses leased could be either small (about 150,000 sq. ft.) or large ( 300,000 sq. ft.). 5 mall warehouses could handle a flow of up to 1.5 million units per year, whereas large warehouses could handle a flow of up to 3 million units per vear. The current warehouse in St. Louis is a small one. The fixed and variable costs of small and large warehouses in different locations are shown in Table 3 . The variable cost is associated with order processing which involves picking and packing of the units ordered by customers. In addition to order processing, inventory handling. such as receiving and shelving the inventory items, also incur costs. Parker estimated that the inventory handling cost at a warehouse was about $480,000Y+0.18F, where F is the number of units flowing through the warehouse per year. Y=1 if the facility is used, 0 otherwise. Thus, a warehouse handling 1,000,000 units per year incurred an inventory handling cost of $660,000 in the year. Individual inventory handling costs could then be lumped together to form the total inventory handling cost of all the warehouses in a city. Gadget.com charges a flat fee of $3 per order from the customers. An average customer order contains three units. Gadget.com in turn contracted with UPS to handle all its outbound shipments. UPS charges were based on both the origin and the destination of the shipment and are shown in Table 4. Management estimated that inbound transportation costs lor shipments from suppliers were likely to remain unchanged, no matter what warehouse configuration was selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts