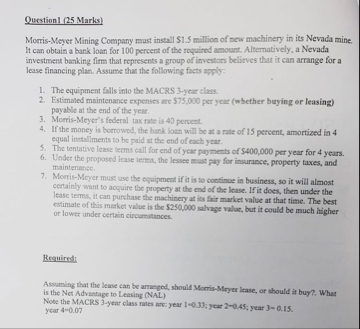

Question: Questionl ( 2 5 Marks ) Morris - Meyer Mining Compary must install $ 1 . 5 miltion of new machinery in its Nevada mine.

Questionl Marks

MorrisMeyer Mining Compary must install $ miltion of new machinery in its Nevada mine. It can obtain a bark loan for percent of the required amount. Atternatively, a Nevada investment banking firm that represents a group of investors believes that it can arrange for a lease financing plan. Assume tha the following ficts apply:

The equipmem falls into the MACRS year class.

Estimated maintenance expenses are $ per year whether buying or leasing payable at the end of the year.

MorrisMeytr's federal tax rate is pervent

If the money is borrowed, the bunk lote will be at a nate of percent, amortized in equal installments to be paid at the end of each year.

The tentative lease terms call for end of year payments of $ per year for years.

Unser the proposed lease iems, the lessee mast pay for insurance, property taxes, and maintenatsc.

MorrisMeyer muss use the equipment if it is to coctinue in business, it will almost certainly want to tocquire the property at the end of the lease. If it does, then under the lease tems, it can purchase the machinery at is firi murket valbe at that time. The best estimate of this market value is the $ salvage valus, but it could be much higher or lower under certain circumstances.

Requireds

Assaming that the lease can be arnaged, should MorrisMryer lease, of should it buy? Whas is the Net Advatage to Leasing NaL

Note the MACRS year class rates ate: year ; yoer ; year year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock