Question: QUESTIONnutes ago a) Explain why Net Present Value is considered technically superior to Payback and Accounting Rate of Returns as an investment appraisal technique even

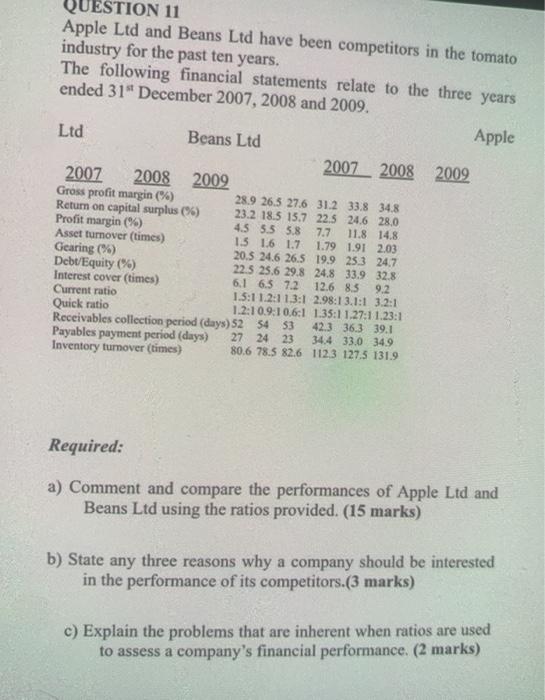

QUESTIONnutes ago a) Explain why Net Present Value is considered technically superior to Payback and Accounting Rate of Returns as an investment appraisal technique even though the latter are said to be easier to understand by management. Highlight the strengths of the Net Present Value method and the weakness of the other two methods. (5 marks) QUESTION 11 Apple Ltd and Beans Ltd have been competitors in the tomato industry for the past ten years, The following financial statements relate to the three years ended 31" December 2007, 2008 and 2009. Apple Ltd Beans Ltd 2007 2008 2009 2007 2008 2009 Gross profit margin (%) 28.9 26.5 27.6 31.2 33.8 34.8 Return on capital surplus (56) 23.2 18.5 15.7 22.5 24.6 28.0 Profit margin (%) 4.5 5.5 5.8 7.7 11.8 14.8 Asset turnover (times) 1.5 1.6 1.7 1.79 1.912.03 Gearing (%) 20.5 24.6 26.5 19.9 25.3 24.7 Debu'Equity (%) 22 5 29.6 29.8 24.8 33.9 32.8 Interest cover (times) 6.1 6.5 7.2 126 8.5 9.2 Current ratio 1.5:1 1.2:1 1.3:1 2.98:13.1:1 3.2:1 Quick ratio 1.2:10.9:10.6:1 1.35:1 1.27:1 1.23:1 Receivables collection period (days) 52 54 53 42336.339.1 Payables payment period (days) 27 24 23 34.4 33.0 34.9 Inventory turnover (times) 80.6 78.5 82.6 1123 127.5 131.9 Required: a) Comment and compare the performances of Apple Ltd and Beans Ltd using the ratios provided. (15 marks) b) State any three reasons why a company should be interested in the performance of its competitors.(3 marks) c) Explain the problems that are inherent when ratios are used to assess a company's financial performance. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts