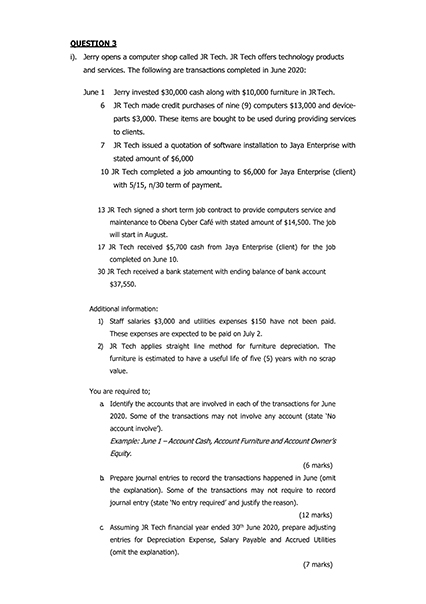

Question: QUESTIONS 0. Jerry opens a computer shop called JR Tech. JR Tech offers technology products and services. The following are transactions completed in June 2020:

QUESTIONS 0. Jerry opens a computer shop called JR Tech. JR Tech offers technology products and services. The following are transactions completed in June 2020: June 1 Berry invested $30,000 cash along with $10,000 furniture in JR Tech. 6 R Tech made credit purchases of nine (9) computers $13,000 and device parts $3,000. These tems are bought to be used during providing services to clients. 7 PR Tech issued a quotation of software Installation to Jaya Enterprise with stated amount of $6,000 10 JR Tech completed a job amounting to $6,000 for Jaya Enterprise (client) with 5/15, 1/30 term of payment. 13 R Tech signed a short term job contract to provide computers service and maintenance to Obena Cyber Cafe with stated amount of $14,500. The job will start in August 17 JR Tech received $5,700 cash from Jaya Enterprise (client) for the job completed on June 10 30 JR Tech received a bank statement with ending balance of bank account $37,550. Additional information: 1) Staff salaries $3,000 and utilities expenses $150 have not been paid. These expenses are expected to be paid on July 2. 2 R Tech applies straight line method for furniture depreciation. The furniture is estimated to have a useful life of five (5) years with no scrap value You are required to: a Identify the accounts that are involved in each of the transactions for June 2020. Some of the transactions may not involve any account state No account involve Example: Ane 1 - Account Cash, Account Furniture and Account Owner's Equity (6 marks) Prepare journal entries to record the transactions happened in June (omt the explanation). Some of the transactions may not require to record Journal entry (state "No entry required and justify the reason). (12 marks) Assuming R Tech financial year ended 30 June 2020, prepare adjusting entries for Depreciation Expense, Salary Payable and Accrued Utilities Comit the explanation) (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts