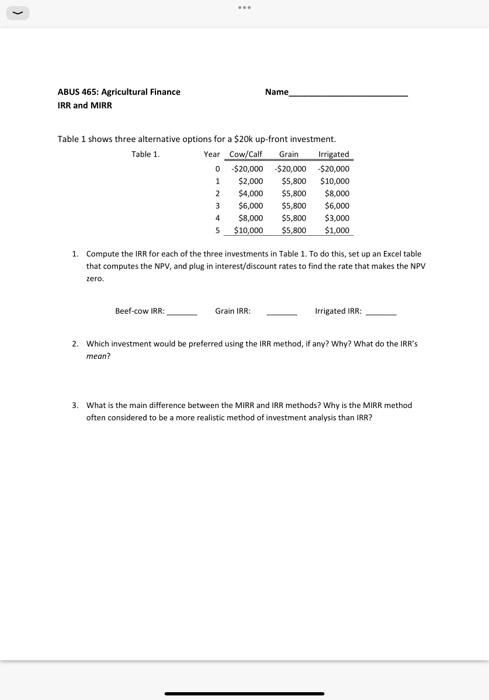

Question: questions 1, 2, 3, 4, & 5 > ABUS 465: Agricultural Finance IRR and MIRR Name Table 1 shows three alternative options for a $20k

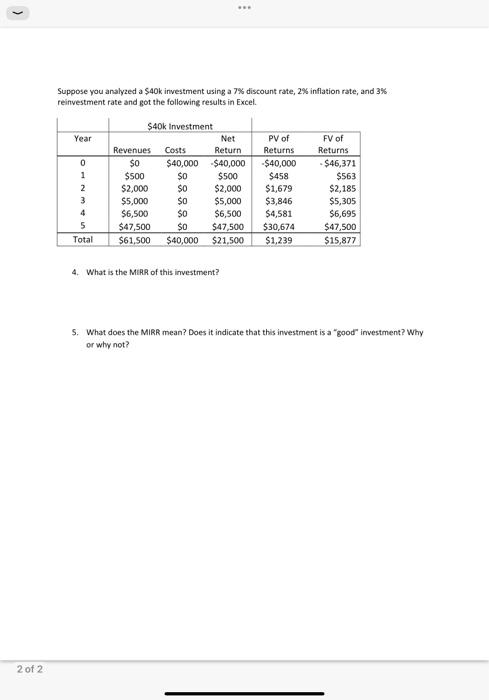

> ABUS 465: Agricultural Finance IRR and MIRR Name Table 1 shows three alternative options for a $20k up-front investment. Table 1 Year Cow/Call Grain Irrigated 0 $20,000 -$20,000-$20,000 1 $2,000 $5,800 $10,000 2 $4,000 $5,800 $8,000 3 $6,000 $5,800 $6,000 4 $8,000 $5,800 $3.000 5 $10,000 $5,800 $1,000 1. Compute the IRR for each of the three investments in Table 1. To do this, set up an Excel table that computes the NPV, and plug in interest/discount rates to find the rate that makes the NPV Zero. Beef-cow IRR: Grain IRR Irrigated IRR: 2. Which investment would be preferred using the IRR method, if any? Why? What do the IRR's mean? 3. What is the main difference between the MIRR and IRR methods? Why is the MIRR method often considered to be a more realistic method of investment analysis than IRR? ... ( Suppose you analyzed a $40k investment using a 7% discount rate, 2% inflation rate, and 3% reinvestment rate and got the following results in Excel Year 0 1 2 3 4 5 Total $40k Investment Net Revenues Costs Return $0 $40,000 $40,000 $500 $0 $500 $2,000 $0 $2,000 $5,000 $0 $5,000 $6,500 $o $6,500 $47,500 $0 $47,500 $61,500 $40,000 $21.500 PV of Returns $40,000 $458 $1,679 $3,846 $4,581 $30,674 $1,239 FV of Returns -$46,371 $563 $2,185 $5,305 $6,695 $47,500 $15,877 4. What is the MIRR of this investment? 5. What does the MIRR mean? Does it indicate that this investment is a good" investment? Why or why not? 2 of 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts