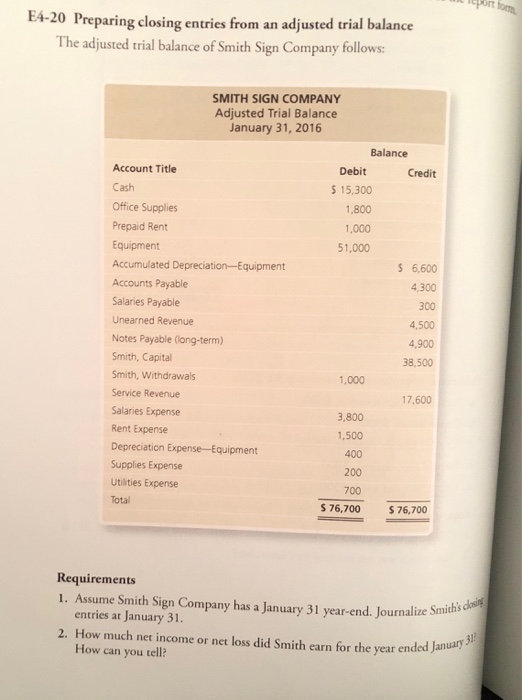

Question: Questions 1 & 2 cpor E4-20 Preparing closing entries from an adjusted trial balance The adjusted trial balance of Smith Sign Company follows SMITH SIGN

cpor E4-20 Preparing closing entries from an adjusted trial balance The adjusted trial balance of Smith Sign Company follows SMITH SIGN COMPANY Adjusted Trial Balance January 31, 2016 Balance Debit 15,300 ,800 1,000 51,000 Credit Account Title Cash Office Supplies Prepaid Rent Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Smith, Capital Smith, Withdrawals Service Revenue Salaries Expense Rent Expense Depreciation Expense-Equipment Supplies Expense Utilities Expense Total 6,600 4.300 300 4,500 4,900 38,500 1,000 17,600 3,800 1,500 400 200 70000 $76,700 $76,700 Requirements 1. Assume Smith Sign Company has a January 31 year-end. Journalize Smiths entries at January 31. 2. How much net income or net loss did Smith earn for the year ended January How can you tell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts