Question: Questions 1 - 9: Consider the following capital structure for AAA Corporation. The company has one debt issue, preferred stock and common stock in its

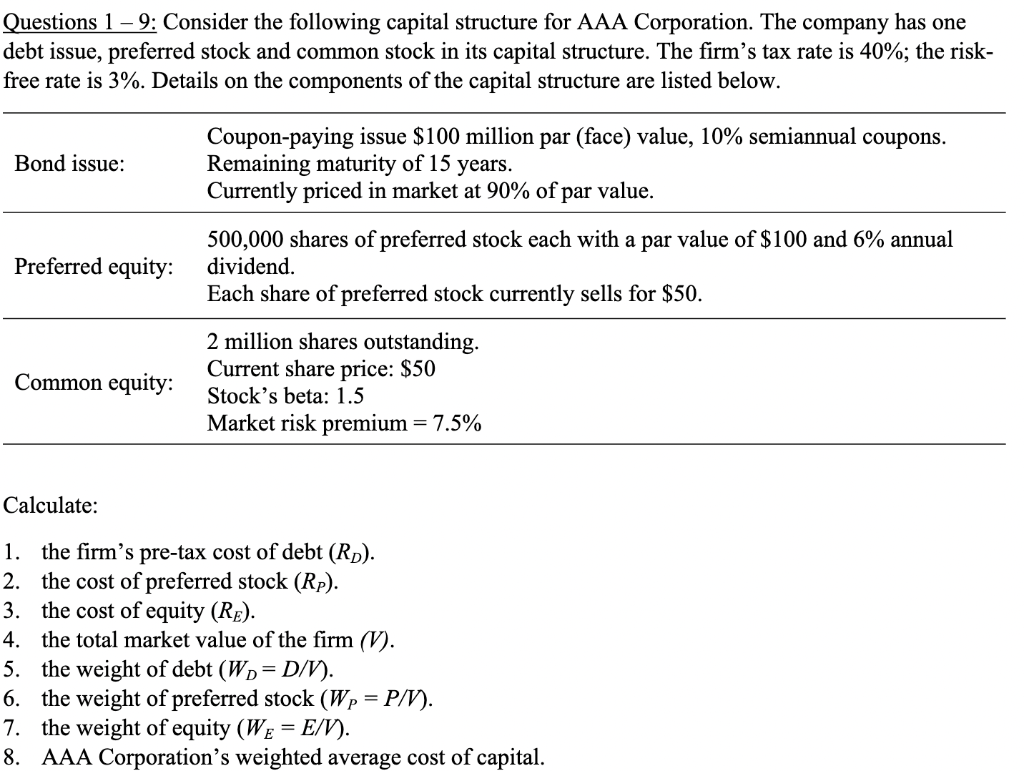

Questions 1 - 9: Consider the following capital structure for AAA Corporation. The company has one debt issue, preferred stock and common stock in its capital structure. The firm's tax rate is 40%; the riskfree rate is 3%. Details on the combonents of the capital structure are listed below. Calculate: 1. the firm's pre-tax cost of debt (RD). 2. the cost of preferred stock (RP). 3. the cost of equity (RE). 4. the total market value of the firm (V). 5. the weight of debt (WD=D/V). 6. the weight of preferred stock (WP=P/V). 7. the weight of equity (WE=E/V). 8. AAA Corporation's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts