Question: Questions 1. Evaluate the projects using the NPV criterion. 2. Assume that the company has the option to liquidate the investment undertaken under Question (a)

Questions 1. Evaluate the projects using the NPV criterion. 2. Assume that the company has the option to liquidate the investment undertaken under Question (a) above, for 200,000, at the end of the first year. Recalculate the NPV of the project bearing in mind this option. Does the option increase the NPV value or not? Why?

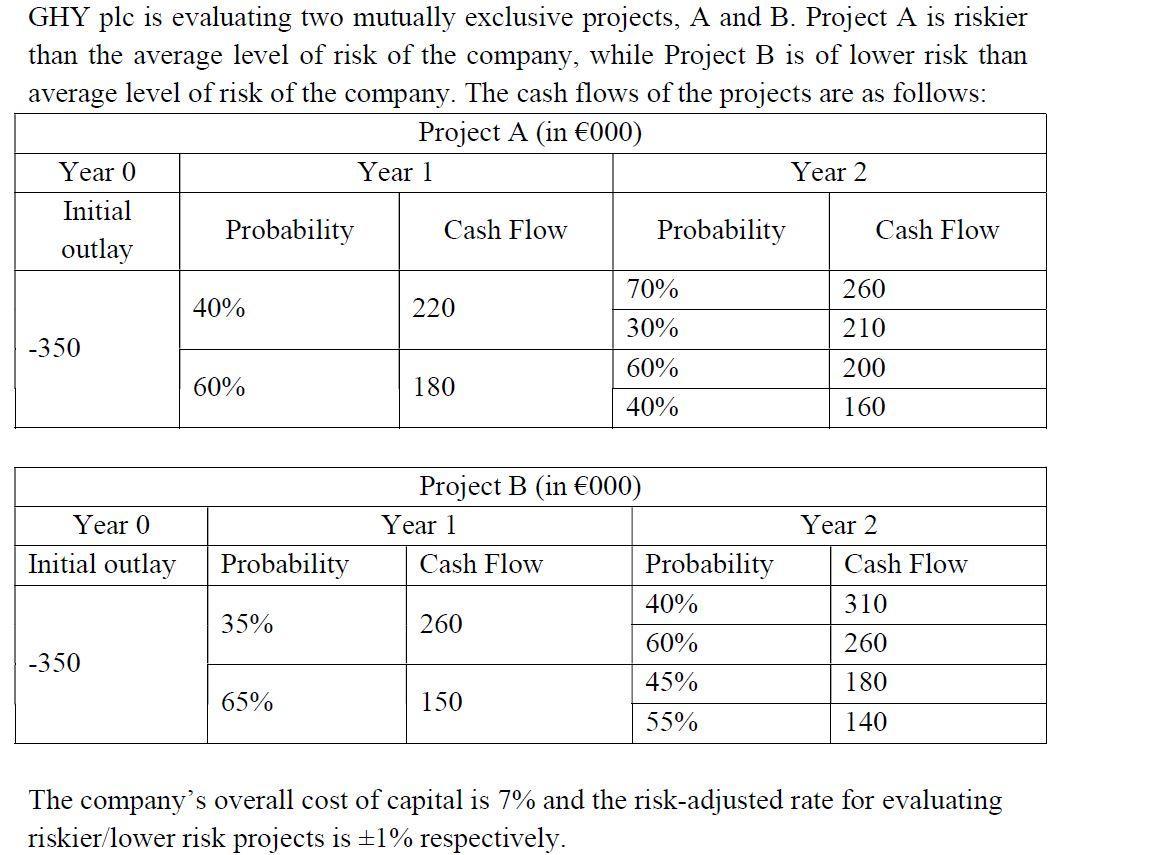

GHY plc is evaluating two mutually exclusive projects, A and B. Project A is riskier than the average level of risk of the company, while Project B is of lower risk than average level of risk of the company. The cash flows of the projects are as follows: Project A (in 000) Year 0 Year 1 Year 2 Initial Probability Cash Flow Probability Cash Flow outlay 260 40% 220 70% 30% 60% 210 -350 200 60% 180 40% 160 Year 0 Initial outlay Year 2 Cash Flow Probability Project B (in 000) Year 1 Cash Flow Probability 40% 260 60% 45% 150 55% 310 35% 260 -350 180 65% 140 The company's overall cost of capital is 7% and the risk-adjusted rate for evaluating riskier/lower risk projects is +1% respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts