Question: Questions: 1. Explain these: (20 marks) a. Please explain risk and return tradeoff and efficient frontier (describe with chart). b. Please explain the shifting of

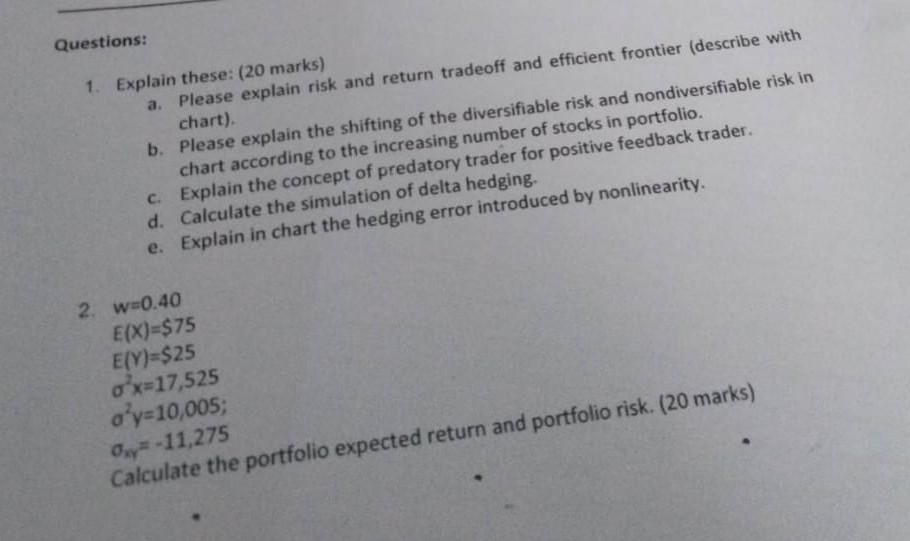

Questions: 1. Explain these: (20 marks) a. Please explain risk and return tradeoff and efficient frontier (describe with chart). b. Please explain the shifting of the diversifiable risk and nondiversifiable risk in chart according to the increasing number of stocks in portfolio. Explain the concept of predatory trader for positive feedback trader. d. Calculate the simulation of delta hedging. e. Explain in chart the hedging error introduced by nonlinearity. 2. w=0.40 E(X)=$75 E(Y)=$25 o'x=17,525 o'y=10,005; 0x=-11,275 Calculate the portfolio expected return and portfolio risk. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts